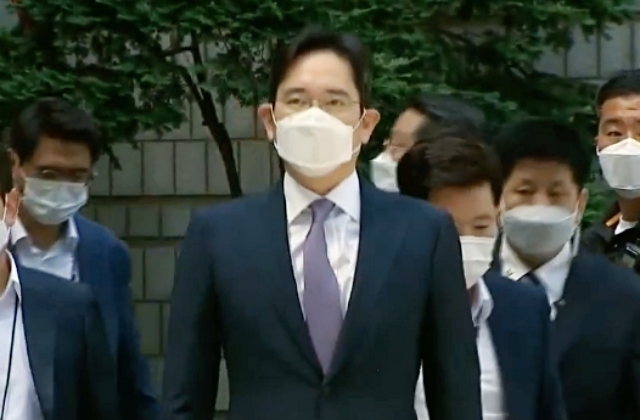

Lee Jae Yong, the Samsung heir and currently leading the company, has been released from prison earlier than he was sentenced for. This happened as businessmen, and some politicians petitioned for his early release through pardon.

Business leaders stepped up to request for Lee Jae Yong’s release because they said Samsung needs its head, especially at this time when chip shortage has been creating problems for most companies in the tech and automotive industries. They also reasoned that without Lee in the office, foreign companies could benefit from the businesses that Samsung will not be able to do as its chief is not able to work.

In any case, Lee Jae Yong has other offenses aside from the bribery and embezzlement cases that he was previously convicted of. One of them is his alleged illegal use of propofol, and the verdict for this case has been handed down recently.

According to The Korea Herald, the Samsung leader will have to pay ₩70 million in fines or around $59,200. This means the court found him guilty for the use of the anesthetic medication when he has not been medically prescribed with it.

The court revealed the final decision this week. It was reported that the fine was finalized as the prosecutors and Lee Jae Yong have not filed an appeal during the deadline or the last day of the seven-day window to submit an appeal to the court.

Last week, the Seoul Central District Court ordered the Samsung leader to pay a fine for violations of South Korea’s Narcotics Control Act. Since he did not file an appeal for this, it was determined that he would settle the hefty fine.

Lee Jae Yong was first indicted for illegal propofol use in June. Based on the court documents, he took the medication for a total of 41 instances between January 2015 until May of last year. He was said to have used the regulated medication for other use and not for medical treatment.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals