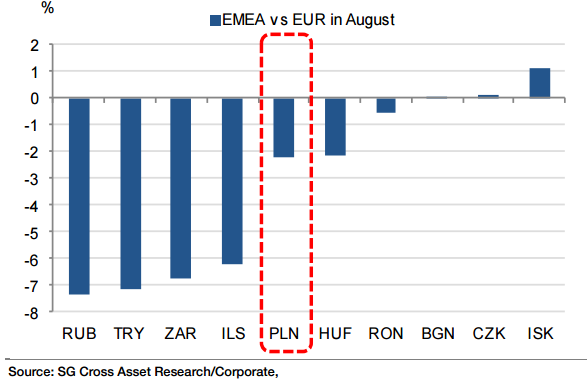

Poland's smaller trade linkages to China and its status of net commodity importer places the PLN in a relative sweet spot compared to other EM currencies. That did not stop EUR/PLN from gaining 2.1% in August. A move up to 4.30 is not ruled out if equity market turmoil persists and the run-up to Poland's general election adds political uncertainty.

USD/PLN rose only 0.14% over the past month and has failed so far to exit the 3.6297-3.8566 trading range in place since May. The economy expanded 3.3% yoy in Q2-15 while CPI edged up in July to -0.7% from -0.8% in June. The NBP kept its key interest rate unchanged at 1.50% on 2 September.

"Our EM colleagues initiated a long PLN/ZAR trade at 3.32", says Societe Generale.

Poland’s October election adds downside PLN risk

Friday, September 4, 2015 1:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals