Analysts and economists at different investment banks are unanimous over one thing at least, Brazil's economic situation is quite bad and it is likely to get worse going ahead.

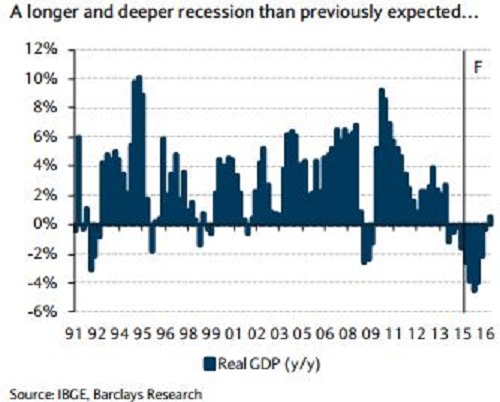

According to latest projection by economists at Barclays, Brazil is likely to face much prolonged recession than originally assumed.

Key problems -

- Brazil is facing worsening current account deficit, due to weaker commodity prices, lower demand for exports due to weakness in China, lower value of Real, deteriorating terms of trade for Brazil.

- Current President Dilma Rousseff's government is struggling to balance budget in a time of recession and heavy political protests. This means fiscal deficit is likely to remain large for quite some time now.

- The president might face impeachment as protest rise all across country and there are rebellions within her own party.

- Facing crisis, domestic demand in Brazil is likely to drop further.

Economists at Barclays are expecting Brazil to face much deeper recession this year, with economy shrinking as much as -3.2% against previous prediction of 1.1% contraction.

Brazilian Real is currently trading at 3.784 per Dollar, down more than 47% this year so far. Further downside is likely.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?