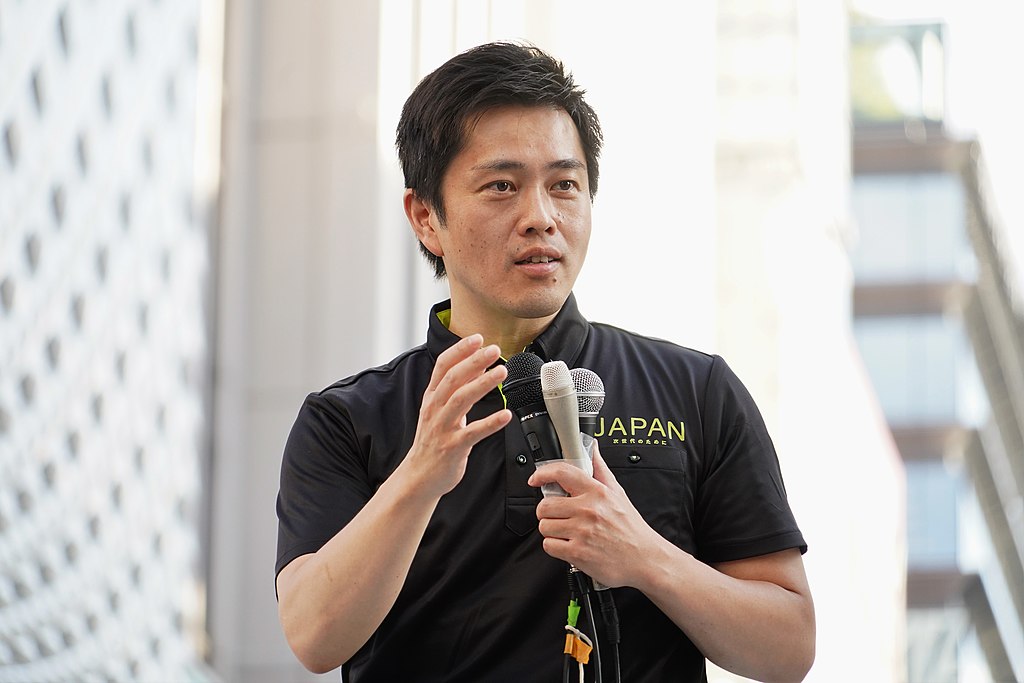

Japan’s ruling coalition is signaling a clear stance on monetary policy independence while advancing plans for fiscal stimulus to strengthen the economy. Hirofumi Yoshimura, leader of the Japan Innovation Party (Ishin) and junior partner in Prime Minister Sanae Takaichi’s coalition government, said the Bank of Japan (BOJ) must remain free from political interference as markets anticipate further interest rate hikes.

In a recent interview, Yoshimura stressed that decisions on Japan interest rates should be left to the BOJ, not politicians. He noted that while a potential rate hike could increase mortgage rates and cause short-term pain, the central bank must act based on market conditions. With the yen’s recent weakness, a rate increase remains possible. The Japanese government, he said, should instead focus on economic policies that help the country absorb the impact of tighter monetary policy.

Japan’s weak yen has become a major market concern, influencing inflation and raising import costs. Although a softer currency benefits exporters, it pressures households facing higher living expenses. The dollar recently traded at 152.66 yen after posting its biggest weekly gain since November 2024, intensifying speculation that the BOJ could raise rates again by April.

Alongside monetary policy discussions, the government is pushing forward a proposed two-year suspension of the 8% sales tax on food, currently lower than the 10% consumption tax applied to other goods. Takaichi has pledged to implement the measure during fiscal 2026 to ease the burden of rising living costs. Yoshimura emphasized the need to introduce the tax relief as early as possible.

To offset revenue losses without issuing new debt, officials are considering non-tax revenue sources, including potential use of Japan’s $1.4 trillion foreign exchange reserves. The move reflects the coalition’s broader strategy to balance fiscal stimulus with financial stability, while allowing the BOJ to independently manage interest rate policy amid ongoing currency market volatility.

U.S. Stock Futures Steady as Strong Jobs Data Clouds Fed Rate Cut Outlook

U.S. Stock Futures Steady as Strong Jobs Data Clouds Fed Rate Cut Outlook  Trump Warns Iran as U.S. Deploys Second Aircraft Carrier to Middle East

Trump Warns Iran as U.S. Deploys Second Aircraft Carrier to Middle East  Trump’s Bad Bunny Super Bowl Criticism Sparks Concern Among Latino Republicans Ahead of Midterms

Trump’s Bad Bunny Super Bowl Criticism Sparks Concern Among Latino Republicans Ahead of Midterms  Anduril Eyes $60 Billion Valuation in New Funding Round to Expand Defense Manufacturing and Autonomous Fighter Jet Development

Anduril Eyes $60 Billion Valuation in New Funding Round to Expand Defense Manufacturing and Autonomous Fighter Jet Development  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Canada Calls for Regime Change in Iran Amid Rising U.S. Military Tensions

Canada Calls for Regime Change in Iran Amid Rising U.S. Military Tensions  BOJ Governor Ueda Meets PM Takaichi as Markets Eye Possible Rate Hike

BOJ Governor Ueda Meets PM Takaichi as Markets Eye Possible Rate Hike  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Democrats Pledge Major Spending on Virginia Redistricting Ahead of Midterm Elections

Democrats Pledge Major Spending on Virginia Redistricting Ahead of Midterm Elections  Ukraine Secures $8.2 Billion IMF Loan as Tax Conditions Are Eased

Ukraine Secures $8.2 Billion IMF Loan as Tax Conditions Are Eased  New Zealand House Prices Dip in January Amid Seasonal Slowdown and Severe Weather

New Zealand House Prices Dip in January Amid Seasonal Slowdown and Severe Weather  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Steady Above $5,000 as Markets Eye Fed Minutes and PCE Inflation Data

Gold Prices Steady Above $5,000 as Markets Eye Fed Minutes and PCE Inflation Data  Gold and Silver Prices Slip After Strong U.S. Jobs Data, Fed Rate Cut Bets Fade

Gold and Silver Prices Slip After Strong U.S. Jobs Data, Fed Rate Cut Bets Fade