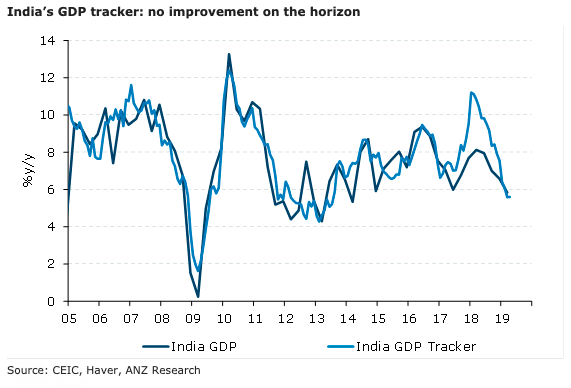

In line with the weakness in Q4 FY19 (quarter ending March 2019) GDP print, India’s FY20 GDP growth is expected to be even slower at 6.5 percent y/y, according to the latest report from ANZ Research.

The general activity and consumption indicators show no let-up. Investment indicators provide some green shoots (like credit to industry and investment proposals), a sustained recovery is however, missing.

The growth slowdown, amid weakness in demand pull inflationary pressures is likely to see the Reserve Bank of India (RBI) cut rates further this year, with expectations of a further 75bps of cuts in the next six months.

However, the bigger risks to this view come from a continued slowdown in manufacturing and consumption indicators and trade-related uncertainties which could impact the export outlook.

While the adverse effects of India’s relegation from the GSP (Generalised System of Preferences) programme will likely be limited given its low coverage, an escalation (India has retaliated with higher custom duties on 28 US products) could be unsettling, the report added.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals