Once again key determinant for Euro's movement will be monetary policy divergence and for that European Central Bank (ECB) remains as key player. However ECB might have lost some of its power to reengineer Euro lower.

Lest first look at what ECB has done so far, in terms of policy actions, with respect to policy divergence.

- ECB deposit rates have been lowered to -0.3%, while keeping the rates for refinancing at 0.05% and marginal lending rates at 0.3%.

- ECB has been purchasing bonds at €60 billion per month since March, 2015 and will be continuing its purchase till March 2017.

- ECB will keep reinvesting the interest and principal received from its purchase beyond end date of QE and for as long as necessary.

It has also been using policy tools like MRO, LTRO and TLTRO to boost growth, however those are not very significant in terms of policy divergence.

So why ECB has lost its firepower to reengineer Euro lower?

- Policy divergence is not dependent on ECB alone, but what other counterparts do. Market is now well pricing hike path from FED, which according to FED's vice chair Fischer, is in line with policymakers' expectations.

- In theoretical terms, carry trade, which has been key driver for currencies in policy divergence environment means borrow at currencies with lower interest rates and invest in currencies with higher interest rates. So while ECB lowered its interest rates for deposits it is not lowering borrowing cost, main refinance rate is kept at 0.05%.

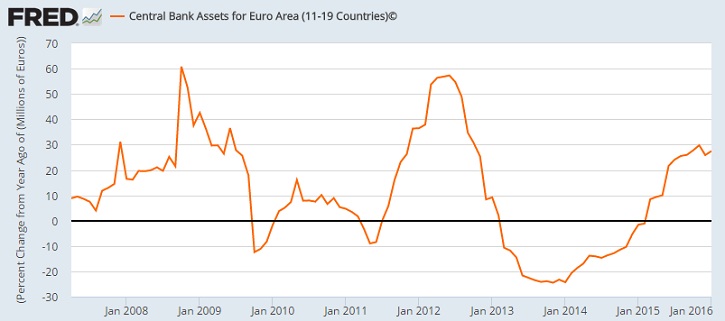

- Our analysis of Euro area central banks' balance sheet shows, expansion is not really occurring at record pace. Both in 2008 crisis, and Euro Zone debt crisis of 2012, expansion pace were far greater.

And finally, ECB's big disappointment in December in terms of policy action means, it has also lost some of its verbal intervention power.

Thanks, to FED, Euro however has remained around low, trading at 1.088 against Dollar.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady