While the worst-case outcome may have been averted in the short run, macroeconomic conditions have deteriorated significantly during five months of unsuccessful talks. With banks having been closed for three weeks, they have reopened this week, but capital controls will most likely remain in place for a protracted period of time, undermining any recovery process.

Greek newspaper, Ekathimerini, reported recently that the Banking Transaction Approval Committee, needed for any foreign transfers, had a backlog of 2500 demands as the process is very slow and priority is being given to low value transactions because of the lack of liquidity.

At the end of Q2, the EC business climate dropped more than 10 points since its last peak in November 2014 - now standing at levels last seen in early 2013. With the exception of retail trade, which has shown some relative resilience up to now, all sub-indices have been nose diving. Annual industrial production growth (SA/WDA) fell back into negative territory in May at -0.6% y/y for the first time since October 2014. Greek Media (in particular, Ekathimerini) have reported that the imposition of capital controls have also severely affected tourism via last minute bookings (20% of annual flow). In turn, Greece's recession looks likely to worsen significantly, although the extent is difficult to gauge with any precision.

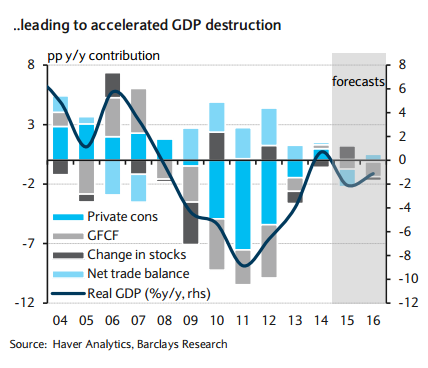

"We have revised down our GDP projections to -2.1% and -1.1% for 2015 and 2016, respectively (from -0.6/-0.1%), mostly as a result of large revisions in H2 15, with downside risks. Net exports are likely to only partially offset extreme recessionary domestic demand. At the end of 2016, we expect domestic demand to be 35% lower than at its peak in Q1 08 (private consumption: -25%; investment: -70%)," says Barclays.

The move back into deep recession is likely to have a sizeable effect on the fiscal situation of the country. From a primary surplus worth 0.4% of GDP in 2014, a primary surplus has been achieved over the first half of this year (€1.3bn for the central government, according to the central bank of Greece) only due to the under-performance of primary expenditures (down almost €3bn from the same period of last year) and additional EU structural funds (vs the 2015 budget).

Furthermore, the Greek government has started to build up arrears. Therefore, Greek public finances are likely much worse now than envisaged only a couple of months ago. Achieving a 1% of GDP primary surplus this year will likely be extremely challenging and is likely to require additional measures, which are going to be difficult to accept by Syriza MPs and by Greek citizens. Additional austerity measures would run the risk of deepening the recession even further and eventually be inefficient in improving the fiscal position of the country.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady