The Reserve Bank of Australia’s (RBA) monetary policy has a duty to maintain price stability, full employment, economic prosperity and the welfare of the Australian people and to achieve these targets RBA maintain an inflation target of 2-3 percent.

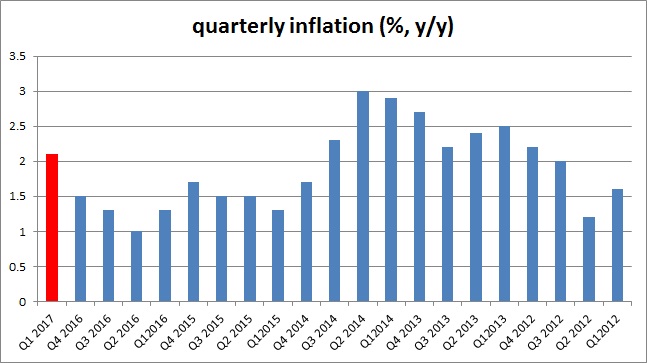

Data released earlier shows that for the first time since 2014, the inflation has reached the RBA’s target range. In the first quarter of 2017, CPI inflation in Australia increased by 2.1 percent from a year ago. Inflation grew by 0.5 percent on a quarterly basis. RBA’s own measure of trimmed mean CPI, which is more of core inflation, grew by 1.9 percent in the first quarter from a year ago. The increase in commodity prices through 2016 and in initial months of 2017 is a contributor to the increase.

However, we don’t expect the RBA to change its policy stance in the first half of the year. The recent slide in commodity prices has already pushed back rising inflation in other key economies like in Germany. Australia may suffer the same fate. In addition to that, the policymakers at the RBA would prefer for the inflation to settle in the middle of the range at least for two to three quarters before they start to change their current wait and watch policy. Currently, RBA is maintaining interest rates at 1.5 percent.

The Australian dollar is currently trading at 0.752, down -0.16 percent so far today.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election