Finance ministers from the Group of Seven (G7) nations met in Banff, Canada, aiming to ease tensions over U.S. President Donald Trump’s tariffs and preserve global economic cooperation. Despite broader disputes, the G7 focused on shared concerns including Ukraine support, China’s non-market practices, and financial crime.

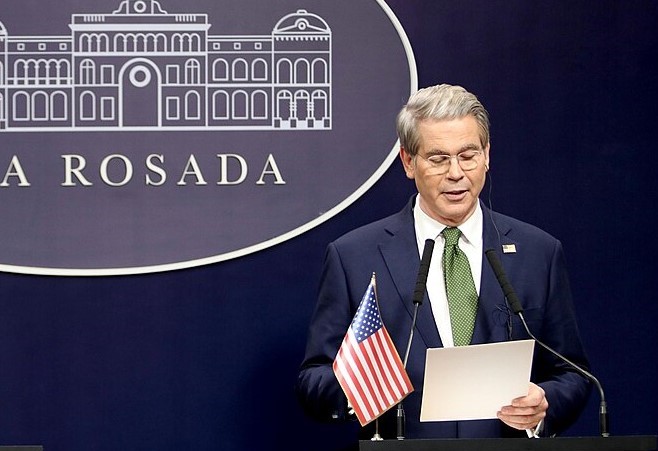

U.S. Treasury Secretary Scott Bessent characterized the meetings as productive, highlighting improved diplomatic tone compared to 2018, when Trump’s tariffs fractured talks. This year, tariffs are more expansive, but G7 ministers attempted to find compromise with Bessent, who was described by European officials as “flexible” and willing to engage.

However, divisions remain. The U.S. opposed language calling Russia’s invasion of Ukraine “illegal,” while Italy pushed to block companies aiding Russia from postwar reconstruction contracts. G7 delegates also debated lowering the $60 price cap on Russian oil, with the EU advocating tighter sanctions.

Bessent’s stance emphasizes U.S. priorities: stricter measures against China’s trade subsidies and reluctance to endorse any communique not aligned with Washington’s goals. Meanwhile, Japan and the U.S. agreed their current dollar-yen exchange rate reflects economic fundamentals, though no specific currency targets were discussed.

Trump’s global trade stance continues to weigh on allies. Japan, Germany, France, and Italy may face U.S. tariffs exceeding 20% by July. Britain still bears 10% duties on most goods, and Canada contends with separate 25% tariffs.

Despite uncertainty over a final joint statement, participants stressed the importance of constructive dialogue. Germany’s Finance Minister Lars Klingbeil and Bessent agreed to continue talks in Washington, signaling efforts to stabilize G7 relations amid mounting global economic pressures.

By balancing cooperation with national interests, the G7 seeks to maintain relevance in shaping global trade and financial policy.

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links