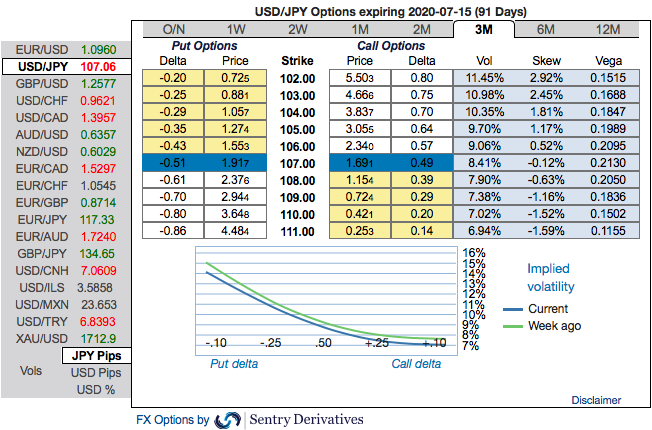

Japanese Yen outperforms in risk-off mood; while BoJ doesn’t cut, doubles asset purchases. The temptation is to be long the USDJPY for now. But with implied vols still elevated and risk reversals heavily favouring USD puts, we continue to look for USDJPY downside.

Earlier this week yen vol curve has inverted the most since GFC and retraced 70% of the 2008 peak, while widening of the risk reversals (in relative terms to ATM vols) has even exceeded the GFC levels. That dislocation has started to reverse.

Our yen analysts see USDJPY above 100. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure.

At spot reference: 107.120 levels, we advocate buying a 2M/2w 108.910/102 put spread (vols 8.95 vs 8.55 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

The rationale: The positively skewed IVs of 3m tenors are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 102 levels (refer 1st nutshell).

To substantiate this bearish stance, one can trace out fresh negative risk reversal numbers that have been added to USDJPY across all tenors, this also signals current hedging interests for the downside risks (2ndnutshell).

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we upheld the same positions, as the underlying spot FX likely to target southwards up to 105 levels in the medium run. Courtesy: Sentry & Saxo

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed