The Reserve Bank of Australia (RBA) maintained the status quo in its monetary policy, leaving key rates unchanged today. As a result, the Aussie dollar could be a beneficiary slightly from this decision as the majority of analysts had widely expected a rate cut. The RBA’s decision could be mainly due to the disappointingly weak inflation in Q1, and the rekindling of the trade conflict between the US and China could easily have become the straw that broke the camel’s back.

However, the RBA continues to maintain that a continued improvement on the labour market will sooner or later cause inflation to return to target levels, in particular as the RBA is likely to be hoping for support for the economy from more expansionary fiscal policies following the elections on 18th May. The limited AUD gains following the decision illustrate the FX market’s continued skepticism though. A rate cut is still seen to be likely and limits AUD’s appreciation potential.

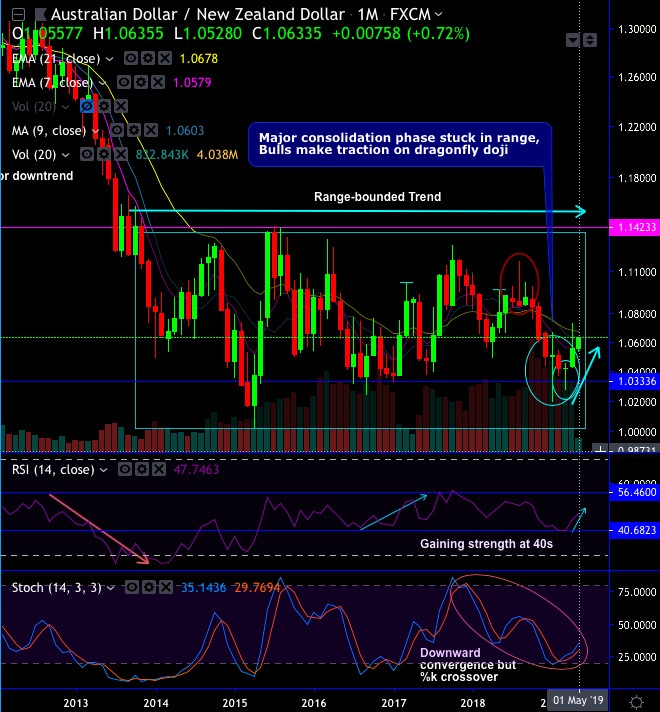

AUDNZD has been oscillating between 1.1425 and 1.0025 levels from last 5 years. The upswings, from the last couple of days, are targeting 1.0685 levels with potential for even higher. The main driving forces at this juncture, is the reversal of NZ-AU yield spreads following the RBNZ’s shift to an easing bias (while the RBA remains neutral). AU economic data has been strong too (retail sales, trade). There’s little major economic news out this week, apart from consumer confidence.

AUDNZD Strangle Shorts: Contemplating the major trend that has been range-bounded (oscillating between 1.1425 and 1.0025 levels), it is wise to deploy (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of the 1m tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of the initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration.

3-Way Straddles Versus ITM Puts: Keeping non-directional movements in the underlying spot FX into the consideration (refer above chart), 3-way straddles are advocated, the strategy comprises of at the money +0.51 delta call, at the money -0.49 delta put options and short in the money put options of narrowed expiry with a view of arresting potential FX risks on either side but capitalizing on minor upswings in the near-term. Hence, on hedging grounds, buy 2m ATM delta puts and ATM delta call of similar tenor and short (1%) in the money put options of 1w are advocated. Courtesy: Tradingview.com, Commerzbank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 42 levels (which is bullish), while hourly NZD spot index was at -96 (bearish) while articulating (at 08:42 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty