The yen’s identity as a risk-averse currency means it has performed badly, even while the recent run of data suggests improving momentum into the end of the year. That improvement should be reflected in another modest lift in the Tankan survey on Wed.

Medium-term outlook: A reluctant to cut BOJ leaves the cross vulnerable to a pullback below 80. With the inflation pulse moving higher helped by the combined sharp rise in commodity prices and the plunge in the yen, there are more reasons for the BoJ to observe from the sidelines.

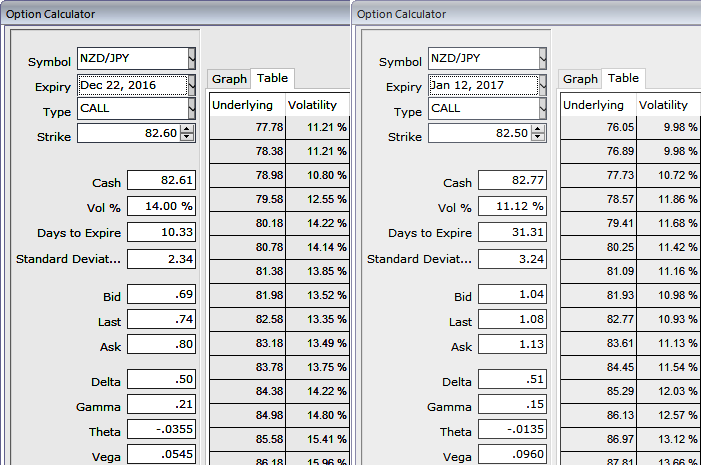

BOJ’s monetary policy is scheduled on Monday and GDT price index on Tuesday, please be noted that the ATM implied volatilities of NZDJPY is spiking above 14% in 10d expiry and steadily above 11.12% in 1m tenors ahead of BoJ’s monetary policy that is scheduled for next week and followed by Kiwis growth numbers.

We’ve already emphasized the NZDJPY’s bullish sentiments in our recent technical write-up, the breach above 82.786 would take the bull trend to hit 83.780, the upswings have gone consistently above DMAs & now at 11-1/2 month’s highs.

Hence, we reckon vanilla like structures in HY IVs times, at the money gamma calls are the most conducive instruments as an upside hedging vehicle as this tool is indicative of the rate of change of the delta values with respect to the upside movement of the rate in the underlying market. In the Sensitivity table, Gamma explains as to how much the delta would shift if the underlying spot FX moves by 1%.

Alternatively, those who want to play it safe with reducing cost trade, the same gamma calls are encouraged in call ratio back spreads as both short-term abrupt dips are monitored, while medium-term upside risks are kept on check, bidding 1w/1m IVs and risk reversals, we recommend initiating longs in 2 lots of 1m at the money gamma call options, while writing 1m (1%) in the money call options, the strategy is to be constructed at net debit, risk averse can also prefer diagonal expiries in this strategies.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis