In the euro area, we see a recovery in German factory orders (actual 1% versus 0.2% consensus, previous 0.3%) and informative minutes from the ECB September meeting. In particular, we look for hints as to why the council remained silent about its QE program end date and design.

Technically, from the last couple of months, this pair seems to have taken support across 20EMAs in Bollinger bands or a lower side of the symmetric triangle and kept rising in its price.

Hedging Strategy:

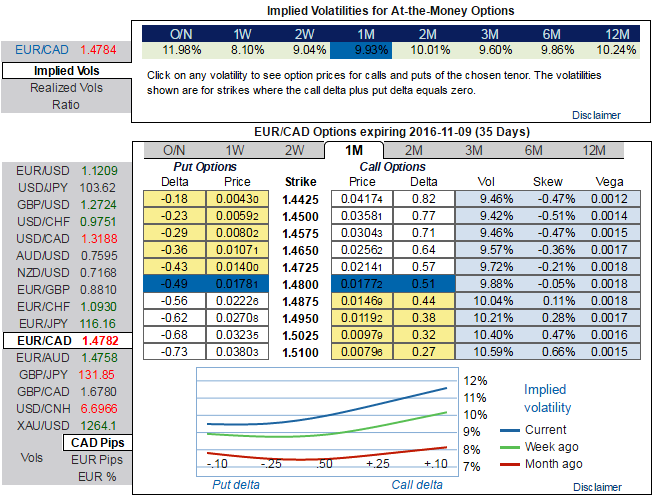

As you can see diagram, the skews in implied volatility of 1m ATM contracts are trending higher towards OTM call strikes, which means that the FX OTC market’s interests on upside risks.

It is implied that the FX option price of EURCAD to move by 10%, for every 1% shift in the underlying spot.

Hence, we reckon the vega instruments are more conducive in below hedging strategy during bullish euro conditions.

We know the rule that during higher IV circumstances, the market thinks the price has the potential for larger movement in either direction and lower IV implies that the OTC market anticipates the underlying spot price would not move much and so that it is beneficial for option writers.

As a result, one can think of reducing the hedging cost by deploying ITM shorts with narrowed expiries in call back spreads.

Hence, we recommend initiating more long call positions so as to hedge upside risks in this pair, call ratio back spread may probably attain the ideal hedging objective by reducing the hedging cost as well.

Hence, the strategy goes this way,

Long leg: 1M ATM +0.51 delta call, 1 lot of (1%) OTM +0.37 delta call and

Short leg: Simultaneously short 1 lot of deep OTM call (1%) of 2w expiry or with a comparatively shorter expiry in the ratio of 2:1.

Currently EURCAD is trading at 1.4767, you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes, from spot FX 1.4767 if it travels towards OTM strikes, more chances of expiring in the money and huge changes in premiums, so these options pricing seems reasonable, but same is not the case with higher strikes.

The lower strike short calls seems little risky but because IV is reducing, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost. As you can clearly observe that the irrespective of underlying spot rates, the above positions likely to derive positive cashflows.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data