NZ RBNZ Official Cash Rate review: (scheduled on June 26th, Previous: 1.50%, Consensus: 1.50%)

In May, the RBNZ cut the OCR and mentioned that the outlook was finely balanced between having to cut once more at some stage or leaving the OCR on hold at 1.5% for an extended period. The RBNZ has stated that it is now in “data-watching mode”, meaning it could jump either way depending on what happens.

RBNZ is now expected to leave the OCR on hold in this upcoming June meeting review. The balance of risks has evolved in the direction of another cut (mainly due to global developments), but not so emphatically that the RBNZ needs to cut the OCR again so soon.

As discussed in this week’s essay, we now think the odds favor the RBNZ cut the OCR to a new low of 1.25% in August. Hence, we reckon that the prevailing rallies of NZDUSD are momentary, NZD is expected to depreciate towards 0.61 levels by year-end.

In contrast to Australia, where the export-relevant commodity markets are already tight, New Zealand’s agricultural exports are subject to both a negative demand shock (China), and a loss of market share (negative domestic supply shock with rising global supply). Dairy prices have weakened, dragging the trade balance to the widest deficit in a decade. While the fall in oil prices will likely offer some reprieve, exports remain constrained and are unlikely to benefit from a redistribution of China’s GDP growth toward fixed asset investment.

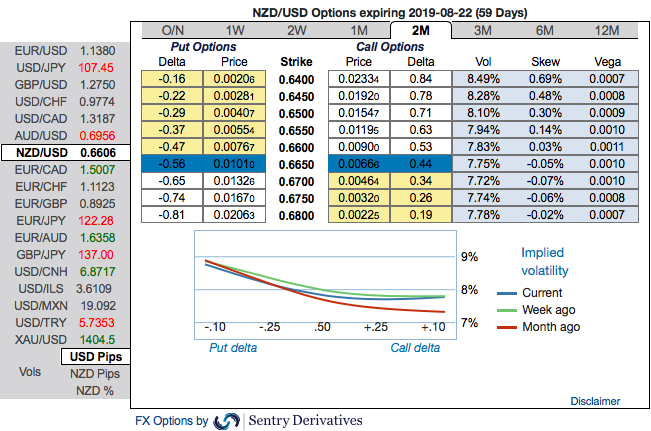

Most importantly, 3m IV skews are right indications for NZD that have clearly been indicating bearish risks. Hence, the major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.64 levels (refer above nutshells evidencing IV skews).

The global risks are reckoned to play less conducive for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. NZD is expected to depreciate to 0.60 by year-end.

While the NZDUSD trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDUSD shorts via options in the past that with ITM put instruments which are most suitable amid prevailing conditions. 3m NZDUSD (1%) in the money put options have been advocated, in the money put option with a very strong delta will move in tandem with the underlying.

The trade projection is now out of the money but we maintain exposure given tail risks to high beta FX as noted earlier. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 5 levels (which is neutral), while hourly USD spot index was at -79 (bearish) while articulating (at 08:16 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data