The US Federal Reserve delivered another quarter-point increase in interest rates at its December meeting, an outcome that was widely expected. Moreover, the Fed continued to signal that further hikes were warranted, though it lowered its expectations for next year with the ‘dot plot’ now showing two quarter-point increases in 2019 (down from three previously). Meanwhile, early this morning, the Bank of Japan unsurprisingly left policy unchanged with Governor Kuroda suggesting that it was too early to discuss the BoJ exiting from its current ultra-loose monetary policy stance.

OTC update and trade recommendations: Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 109.50 levels so that OTM instruments would expire in-the-money.

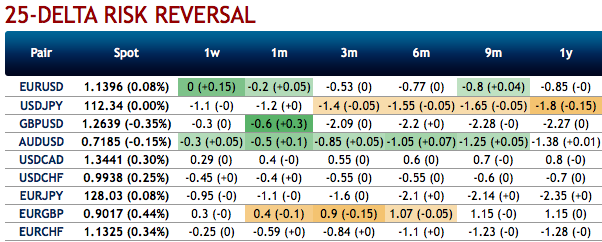

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run. IVs for 2w tenors are on lower side which is good for put option writers, while 2m IVs are on higher side which is good for put holders.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 111.83 levels, we advocate buying a 2M/2w 113.723/109.00 put spread on Fed and BoJ monetary policies (vols 7.52 vs 6.35% choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 82 levels (which is bullish), while hourly USD spot index was at -61 (bearish) while articulating at (09:00 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays