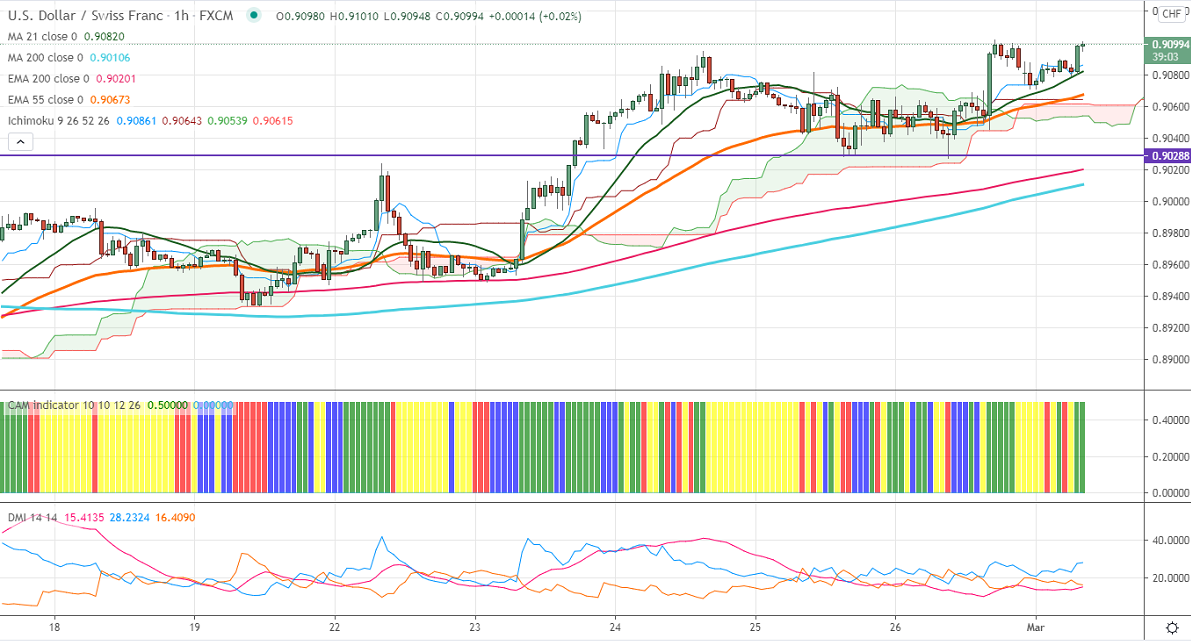

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.90847

Kijun-Sen- 0.90693

USDCHF is trading extremely higher and broken significant resistance 0.9090 on broad-based US dollar buying. The surge in US 10-year yield is supporting the US dollar index. US dollar index is holding well above 90.50 levels, any indicative break above 91 confirms minor bullishness. The board-based US dollar buying on surging US bond yield is supporting the pair at lower levels. Markets eye US ISM manufacturing and construction spending for further direction.

The near-term resistance at 0.91375; any convincing violation above will take to the next level till 0.9170/0.9200. Significant trend reversal only above 0.9300.

On the lower side, significant support stands at 0.9070, any indicative break below targets 0..9050/0.9020/0.8978.

Indicator (1-hour chart)

CAM indicator – bullish

Directional movement index – Bullish

It is good to buy on dips around 0.9078-80 with SL around 0.9040 for a TP of 0.9200.