There is merit in earning carry in risk efficient form, and we sell USDTRY 1Yx1Y FVAs hedged with a static vanilla ATM call.

USDTRY 1Yx1Y FVAs an appealing shorts, we are not chasing the drop in USD gamma lower; however, we identified the richness in 1Yx1Y USDTRY forward vols as a shorting opportunity. Given the sharp rally in USDTRY since November, the vol curve is in a very unusually inverted shape in front dates.

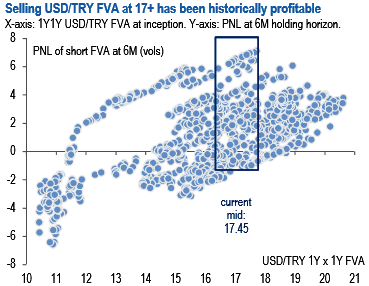

However, forward vols post 1Y remains elevated, and shorting FVAs at current levels has been generally profitable (refer above chart). In the 17 handle, it would take a vol spike above the highs of 2008-2009 for the short FVA to expire out-of-the-money at expiry.

To mitigate the risk of MTM losses, one can hedge out the implied short spot-vol correlation of the FVA by buying a 1Y USDTRY call. As we had noted previously, a market long USD has led to softer RRs, especially in longer dates (“A telegraphed USD rally makes longer-dated USD risk-reversals better value than short-dated ones”,). Indeed 1Y USDTRY RRs are cheap relative to forward vols, making vanilla hedges good value.

In particular, 1Y ATM calls, with $ notionals sized at 50 times the $ vol notional of the FVA – for instance: $5 mln vanilla notional for $100k FVA notional – have efficiently removed tail-risks over the past four years.

Initiate a short position hedged buy buying an ATM (DNS) call in 1:0.5 vega amounts, ahead of the MPC meeting, expecting the central bank to raise its corridor and thus stabilize FX markets.

The CBRT ended up under delivering in its monetary tightening (“the CBRT hikes less than market expectations, but vows to do more if needed”), and the resulting leg up in USDTRY proved the largest contributor to the PNL, just as was the case in late 2014 and mid-2016.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation