Over the holiday season, as we stated in our earlier posts USDTRY has been creeping ever closer to the 6.00 mark (refer 2nd chart). To what extent this is the result of low liquidity and to what extent it is the future ‘trend’ will be clear soon after market participants return from holiday. We have long held the view that USDTRY would rise sharply during the next EM risk off episode – the reason for such a view is the asymmetric reaction function of the central bank, which can only cut rates but not hike them; this alone is a sufficient condition for the lira to weaken significantly in the medium-term. Because of TRY’s high carry, we need a strong initial trigger for decline. We open this week following geo-political developments involving the US and Iran, which give us little re-assurance that a risk-off scenario can be excluded in the near-term. What is more, local developments are not helpful either: latest CPI data do not bode well for the lira.

In December, headline inflation accelerated to c.12% and core inflation accelerated back to c.10%. CBT has responded to lira weakness with secondary policy tweaks: a hike to FX RRR by 200bps for banks which are not lending aggressively enough; and plans to impose an additional fee on FX RRR balances.

In late-December, CBT hiked the RRR on forex deposits and participation funds by 200bps, except for banks which are lending fast enough to meet CBT's reference range for real lira loan growth. This move aims to simultaneously incentivise lending, while building up the CB’s FX reserves. The latter policy will impose c. 0.025% fee on RRR balances, in a kind of financial service tax, which will aim to dis-incentivise dollarization of the banking system. From the point of view of the main policy objective at present, which must be to curb lira depreciation, we find these measures to be neutral – not having any effect whatsoever. We look for higher USDTRY levels in the month ahead.

Hedging Strategy:

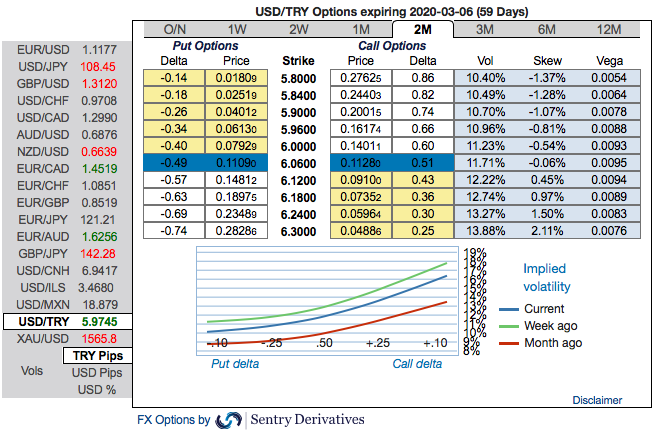

On hedging grounds, 2m USDTRY debit call spreads are advocated with a view to arrest upside risks. Initiated 2m 5.50/6.24 call spreads at net debit. One achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The positively skewed IVs of 2m tenors are bidding for OTM calls strikes up to 6.30 levels (refer 1st chart).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry & Commerzbank

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures