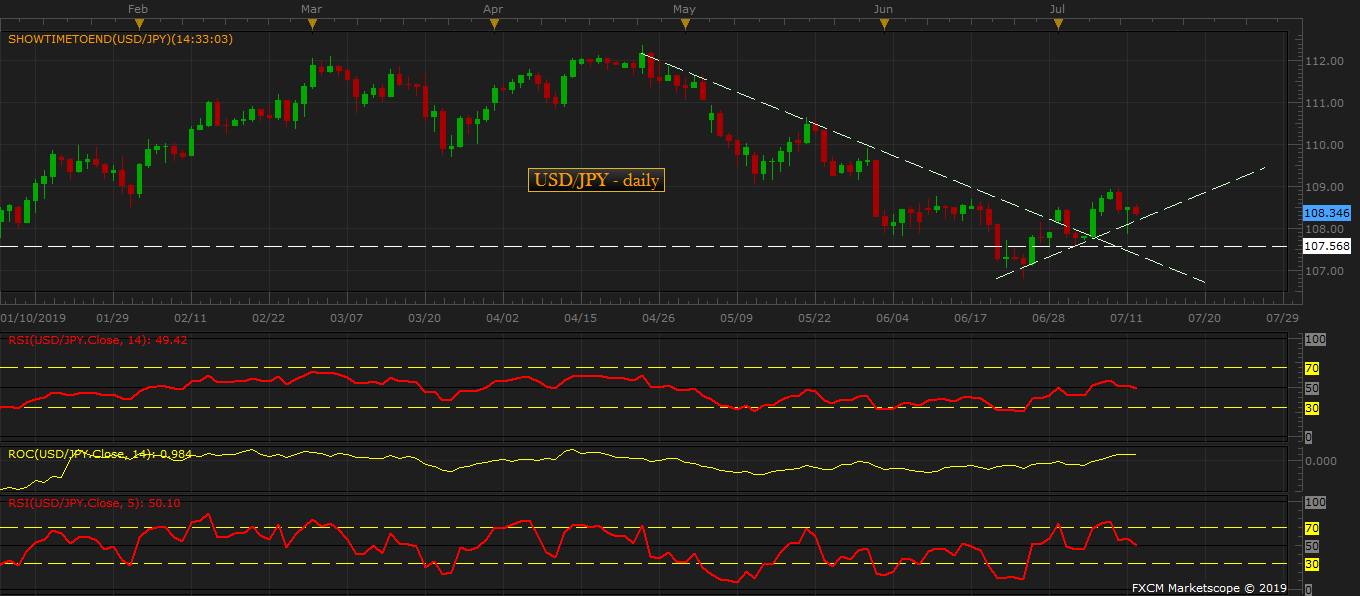

The recent break of a downtrend line, as shown in the daily chart, which has been in place since April 2019, was largely confirmed by yesterday’s price action. The yen was trading strong in the morning during Asian hours, however, the strength started to wane during the European hours and by New York time the yen was in decline against the USD.

The strength in USD/JPY was largely due to the rise in T-bond yields despite Federal Reserve Chair Jerome Powell signaling rate cuts in the near future, and the price action formed a neat bullish hammer candle, which signals further upside potential.

However, the retail sentiment still favors the USD/JPY bears but long USD/JPY positions have declined, suggesting the possibility of a reversal in trend. As of today, 62 percent of the retail positions are long USD/JPY, while only 38 percent are on the short side, which gives the pair a bearish bias. So the upside may not be smooth despite the hammer candle.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed