The CAD is trading defensively into the weekend, prior to which it was shining major portion of its 3.17% rally from the late June highs. But CAD weakness is likely to be limited, however, as the CAD remains significantly undervalued relative to our estimated equilibrium based on interest rate differentials and oil prices. We anticipate continued CAD strength into and through next Wednesday’s BoC policy decision and MPR forecast update and look to significant CAD strength on the crosses.

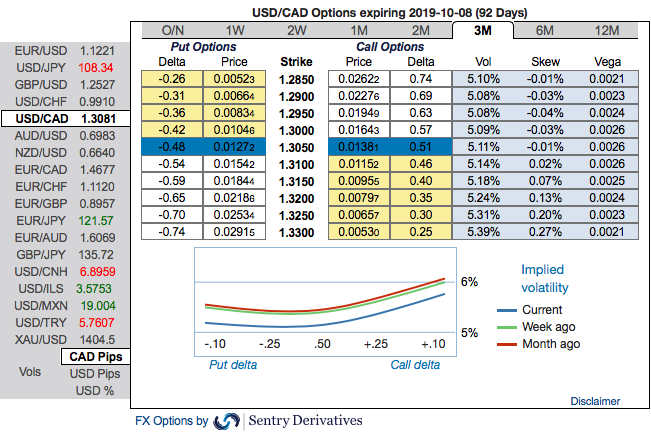

At spot reference: 1.3080 level while articulating, we advocate diagonal debit call options spreads foreseeing both mild downswings in the near-term and the major uptrend. Positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.33 level. Bullish neutral risk reversal numbers substantiate this bullish stance coupled with 1m skews that are well-balanced on either side.

Well, contemplating above driving forces and OTC updates, diagonal call spreads as preferred option structures seem the best suitable under prevailing circumstances given elevated skew and favorable cost reduction.

Execute USDCAD 3m/2w call spread strategy (strikes 1.3080/1.33) for a net debit.

The rationale:

Firstly, as you could observe the underlying spot of USDCAD has dipped below 1.33 level with bearish sentiments from the last 1-month or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side. Source: Sentrix, & Saxobank

Currency Strength Index: FxWirePro's hourly USD spot index was at -25 (mildly bearish), CAD is flashing at -81 (highly bearish), while articulating at (06:50 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand