The pessimistic USD outlook is based on the expectations that growth will rise globally, causing other major central banks like the ECB and the Bank of Japan to normalize their monetary policies. What supports this view is that US inflation can be used to estimate global inflation pressure.

The higher inflation in the US should, therefore, fuel price pressure globally, increasing the likelihood of a reduction in monetary policy stimulus elsewhere. The currencies of the central banks concerned should benefit from that - at the expense of USD.

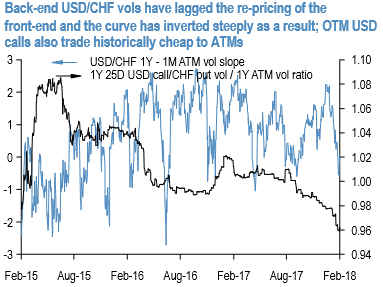

OTM USD calls/CHF puts as a vega play: While 1M CHF ATM vols have jumped 2% pts. YTD, longer expiries have lagged, leading to a fairly steep inversion of the vol curve (refer above 1st chart).

Owning 6M-1Y vega, therefore, carries no roll-down penalty while allowing patience to await a shift in SNB policy. The additional kicker is that longer expiries cover the US mid-term elections which are too far away for the market’s focus now but should gradually gain in importance with the passage of time.

A twist on ATM vega is to own OTM USD calls/CHF puts i.e. the weak / “wrong” side of the risk-reversal on a delta-hedged basis.

The near-extreme bid for USD puts on risk-reversals implies that USD calls trade at a sizeable, multi-year high discount to ATM vols (refer above 1st chart).

In addition to current value, OTM USD calls also have a track record of performing comparably with ATM vols (refer 2nd chart) without costing smile theta, which renders them attractive vehicles to not only position for an SNB rethink that proves more disruptive than markets anticipate, but also a more garden variety equity/dollar correction for which the relatively cheap USD calls are the “correct” side of the risk-reversal to own.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices