Looking at the lira’s rally over the past couple of days, one might be tempted to imagine that some significant positive development has occurred in the background.

We, however, witnessed three negative developments in recent days:

1) CBT’s FX reserves fell sharply further in April, with gross reserves down 3.6%m/m. Net reserves could have fallen more sharply, but official data will follow later. There were media reports that net reserves excluding FX swaps (which expire automatically) had fallen into negative – these latter reports could be using unreliable calculations, hence we discount them. Reserves will climb mildly because of increased FX RRR (hiked by 300bps this month) and some loan repayments in coming months, but this will create a small blip within a declining downtrend.

2) Turkey’s composite economic confidence decreased by a sharp 7.2pts in May to its lowest level since last year’s lira crisis; this behavior suggests that lira weakness is once again exerting stress on household sector confidence, in particular.

3) The lira depreciation trend has re-ignited the private sector’s preference for FX deposits – which is a typical reaction during such episodes and amplifies the original depreciation: FX deposits rose by 10pp to 54% of the total in latest data from 17 May.

On a concluding note, each development is a prominent negative and suggests that clouds on the horizon are getting darker, not lighter. Large external debt rollover requirements are a key source of TRY pressure. Additionally, with renewed political uncertainty the local dollarization trend could resume. The central bank has so far announced technical measures, which may temporarily cushion vulnerability in FX weakness but are unlikely to reverse recent trends.

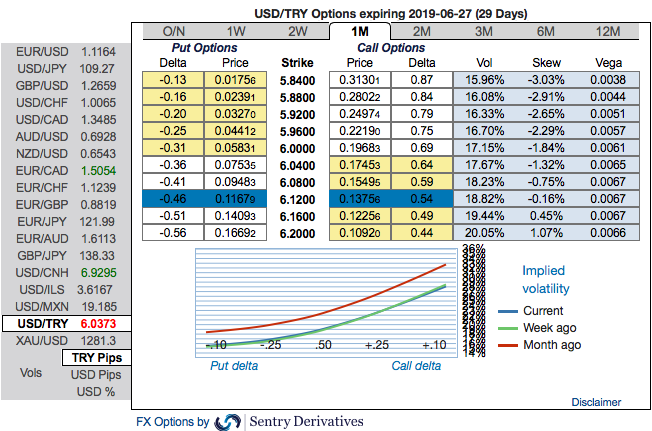

Trade tips: At spot reference: 6.0246 levels, 3m USDTRY debit call spreads are advocated with a view to arresting upside risks. Initiate 3m 5.62/6.54 call spreads at net debit. Thereby, one achieves hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please observe that the above technical chart USDTRY is also clearly indicating the further upside risks.

It seems that hedgers of TRY are interested in the upside as the positively skewed IVs are bidding for OTM calls on the above fundamental factors.

IVs of this underlying pair is on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is desirable for the holder of the option, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Commerzbank & Sentry

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 35 (which is mildly bullish), at press time 13:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data