The underperformance of Swiss franc (CHF) through mid-April was partially driven by market expectations of an eventually benign outcome on global growth on the back of global policy easing which also culminated into FX volatility grinding to the low-end of its decade-long range.

The nascent global growth recovery and the low-vol is regime is now once again being threatened by a re-emergence of a more aggressive US trade policy. While the conditions remain fluid and US-China trade negotiations are still ongoing, a further escalation of the conflict is not likely to bode well for high beta FX and on the contrary, is likely to be supportive for defensive currencies such as CHF given our view that FX markets are currently priced to more optimistic growth outcomes.

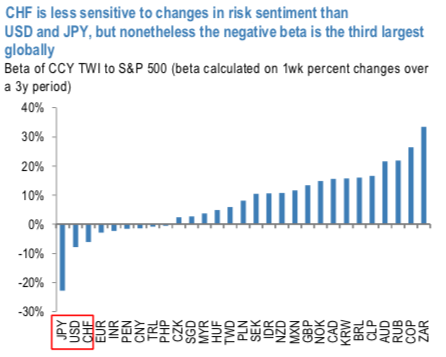

CHF is unlikely to be immune from an escalation of trade conflict which spills into broader risk sentiment. In such an event, the channel of transmission is likely to be the market readjusting to lower growth outcomes and pricing in more risk premia for tail risks. Recall that last year, CHF was among the best performing currencies globally amid the softer growth backdrop and escalating tail risks. While CHF has been less sensitive to changes in risk sentiment (as measured by equities) in comparison to say USD or JPY, CHF (negative) sensitivity to equity markets is the nonetheless the third largest globally (refer 1stchart). The beta has been stable for the past year but has shown signs of increasing in magnitude when the market volatility increases (refer 2nd chart).

6m IV skews of USDCHF are stretched for downside risks (noticeable bids for OTM puts are having higher demand), which means hedgers’ sentiments are positioned for bearish risks.

Positively skewed IVs (implied volatilities are the difference between OTM calls and OTM puts).

To substantiate this bearish stance, although we see some positive shift in risk reversals, negative risk reversal numbers remain intact that signifies hedging outlook for bearish risk sentiments. Courtesy: Sentrix, Saxo & JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 28 (which is mildly bullish), while hourly CHF spot index was at 73 (bullish) while articulating (at 08:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures