A bird's eye on US EIA’s inventory: Energy investors would usually be focused for the US and OPEC’s crude inventories. It is quite a general notion is that a bigger-than-forecasted drop could prompt further cushion for crude oil prices. We run you through the key driving forces of crude price behavior of late.

Crude prices rallied as a risk-on wave hit commodity markets following the news that China was introducing further stimulus measures to help stabilize the economy. Significant tax cuts will be enacted in 2019, while officials promised to strike a balance between tightening and loosening regarding monetary policy. Prices were also supported by rising expectations of another strong draw in US inventories. A Bloomberg survey suggests stockpiles fell by 2.5m bbls to 437.2m bbls in the week ending 11 January. The EIA also released its Short-Term Energy Outlook, with no changes to global demand this year (+1.5mb/d).

However, it lowered its forecast for supply. Signs of further disruptions are also rising. We expect US production growth to decelerate m/m in 1H’19 due to a slowdown in completions. The recent collapse in oil prices further supports our initial assumption which was based on logistical constraints and capital discipline.

Hence we are supportive US light crude at the front end but we believe any support to oil in the front end of the curve would cause the structure of the curve to flip into backwardation as producers will plan for a surge in production towards end of 2019/early 2020 by hedging at the backend of the curve and oil flow will be less constrained as new pipeline capacities come online.

Any slowdown in the US production would also incentivize investors. Additionally, the curtailments in Canada has clearly increased the pull for WTI molecules when the seasonal demand is not met by the Canadian molecule which we believe is likely to be the case for at least few more months ahead of us. Hence this will remain a tactical trade.

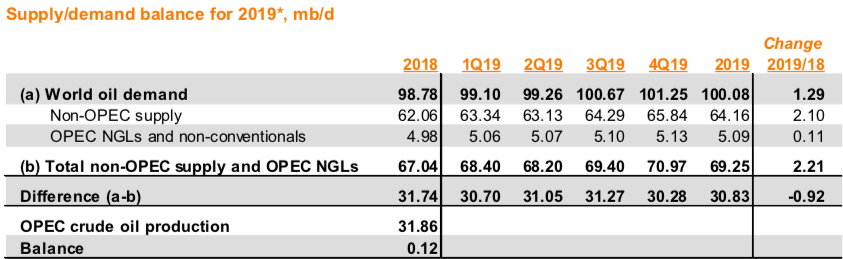

A bird's eye on OPEC’s inventory: The demand for OPEC crude in 2018 is estimated at 32.4 mb/d, which is 1.1 mb/d lower than the 2017 level. In 2019, demand for OPEC crude is forecast at 31.4 mb/d, around 1.0 mb/d lower than the estimated 2018 level. If you observe the above nutshell when considering the world’s oil demand and comparing that with the last quarter’s OPEC’s and rest of the world’s productions, one can easily understand the shortage of supply by 0.12 mb/d.

Trading Recommendations: Anybody on this planet knows this rationale that when supply decreases with the increasing demand forecasted, then naturally, the price of the commodity tends to shoot up. Hence, we’ve already advocated initiating longs in NYMEX WTI June 2019 and short NYMEX WTI December 2019 spread at - $1.19/bbl in the recent past, with a target of +$2/bbl and stop loss of -$2/bbl.

For the same reason described above, we also think WTI will be well supported in the months ahead as Saudi Arabia is also reducing crude exports to the US strategically to reduce US inventories, the price likely to get a cushion in the near terms but the downside price apprehensions remain intact.

Initiate longs in NYMEX WTI June 2019 and short ICE Brent June 2019 at -$7.97/bbl. The target of -$6/bbl and stop loss of -$6/bbl. Courtesy: OPEC, ANZ, JPM

Currency Strength Index: FxWirePro's hourly EUR spot index was at 12 (neutral), USD is at -22 (bearish), at press time 07:26 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close