It only put temporary pressure on Sterling that the current British Prime Minister Boris Johnson achieved only a marginal victory over his rival Jeremy Corbyn during the recent televised debate. For the time being the market clearly does not consider a Tory victory and thus the possibility of a Deal-Brexit (EU exit with a deal) to be at risk. In view of the Tory’s comfortable lead of approx. 10 percentage points in opinion polls that seems justified. Even if the reliability of the polls is seen to be limited due to experience with recent UK elections, they are the only indication of who might win the election. And as a result they are likely to remain a major driver for GBP exchange rates until the election. As long as the Tories are able to defend their lead against Labour, things are looking up for the British currency.

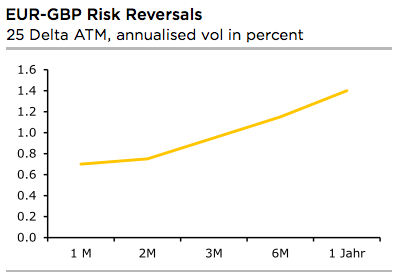

Short term that is. Medium to long term the market remains sceptical. This is reflected in the hedging costs against a collapse of Sterling that remain at higher levels than hedging against strong Sterling appreciation. What is significant is that - despite the elections and the Brexit deadline at the end of January - hedging for the 1-year horizon is more expensive than short term. The recent Sterling strength disguises the fact that the market still sees some stumbling blocks for the currency over the coming year. And indeed, even if Johnson wins the elections and the UK leaves the EU with a deal at the end of January Brexit is not yet done and dusted. The most complicated bit - the negotiations about a trade agreement with the EU - might only begin at that point.

OTC Updates:

The passively skewed IVs of 2m tenors are stretched are indicating upside risks, more bids are observed for OTM call strikes up to 0.88 level.

While EURGBP risk reversals of the existing bullish setup remain intact with freshly added mild bearish shift, you see minor negative risk reversal numbers in the shorter tenor, but it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid the expected turbulent condition. According to the OTC FX surface, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors.

Alternatively, on hedging grounds we advocated initiating directional hedges that comprised of shorts in EURGBP futures contracts of October’19 delivery and simultaneously, longs in futures of December’19 delivery for the major uptrend. Shorts have been expired, we now wish to maintain these positions. Courtesy: Sentrix, Saxo & Commerzbank

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data