GBP’s performance ranks mid-table over the past month (+0.5% vs USD, -2.5% vs EUR) as the global impact of the coronavirus has come to dominate GBP's local difficulties with Brexit. But even though Brexit is now being overshadowed by an even more existential crisis, this doesn’t let GBP off the hook, far from it actually, as the accelerated removal of GBP's interest rate support as the BoE prepares to respond to the COVID-19 shock will further undermine the sustainability of the UK's worst-in-class current account deficit (a 4-5% of GDP current account gap is incompatible with the UK's new reality as a low-growth, low-yielder).

In addition, while Brexit is being overshadowed, this is only temporary and GBP remains vulnerable from a great sense of realism amongst investors about the government's objectives for the EU trade talks and its credible threat still to walk away in the pursuit of regulatory autonomy from the EU and freedom from strict level playing field commitments.

As a result of the Brexit-virus one-two we are lowering the GBP forecast. The point of maximum jeopardy is expected to be around mid-year as the trade talks reach their make-or-break point (remember that the government has legally barred the transition period from being extended beyond end-2020) and the risk of no- deal crescendos.

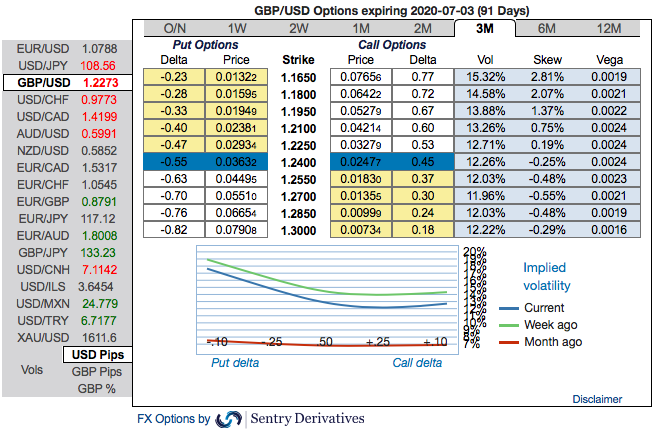

Options Strategy (Debit Put Spread): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling: Stay short a 1M/2W GBPUSD put spread (1.25/1.14), spot reference: 1.2340 level.

The Rationale: Observe the 3m GBP’s positive skewness that has stretched towards OTM Put strikes, hedgers have shown interests for bearish risks.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run. Hence, we advocate the diagonal options strategy on both hedging and trading grounds.

Alternatively, activate shorts in GBPUSD futures contracts of April’20 deliveries with an objective of arresting potential slumps. Courtesy: Sentry, JPM & Saxo

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation