Boris Johnson won the elections he wants things to be move ahead very quickly as far as Brexit is concerned. The new government will present the legislation required for a ratification of the exit agreement for a second reading to the new Parliament on Friday. Due to the Conservative’s large majority in the House of Commons it is generally assumed that the official exit process will go smoothly by the deadline at the end of January.

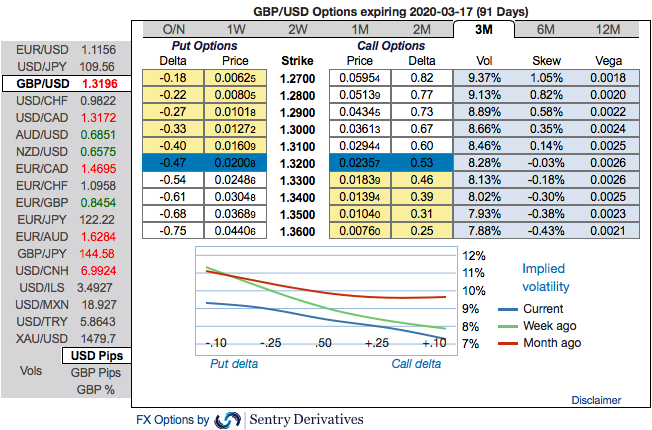

Although GBPUSD appears to be signs of recovery, reversal for the major downtrend needs better clarity. You could still make out GBP hedging sentiments for bearish risks in FX OTC markets though there are minor shift risk reversals.

Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been sensitive on the issue of political event risk premium. The upcoming 2020 US election pricing are gearing to be one of the most eventful in history and as one possible driver capable of breaking the fragile state that global economy lies in at the moment.

OTC outlook: The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks amid the minor positive shift in RRs.

To substantiate the downside risk sentiment, risk reversals have still been signalling bearish hedging sentiments despite some positive shift is observed in the bearish risk reversal numbers in the shorter tenors. Hence, we advocate below options strategy on both hedging and trading grounds.

Strategy (Debit Put Spread): Contemplating above factors, wise to stay short sterling via a limited loss tail hedge: Stay short a 2M/2W GBPUSD bear put spread (1.3425/1.27), spot reference: 1.3205 level.

The Rationale: Brexit might take a backseat as far as Sterling is concerned over the coming months - at least until an extension of the transition period becomes more urgent. Instead focus is likely to turn to the fundamental situation in the UK. The surprisingly weak PMI published yesterday did not constitute a good start in this respect.

What is decisive is how the economic data develops from now on, what would be particularly important would be to find out to what extent the recent weakness of the British economy was due to the Brexit uncertainty, to the trade conflict or even structural factors. If the real economic weakness was to be deeper and therefore longer term this would constitute an ideal breeding ground for rate cut speculation which might weaken Sterling at least temporarily.

We perceive the conservative majority is to likely translate Johnson’s deal into UK legislation in a manner which raises no deal risks at end 2020 as a Conservative majority will bring with it a temptation to reopen the deal to address Brexiteer concerns. Conveniently, the trough of GBP term structure is currently at 1Y tenor, making an outright 1Y to 18M vega ownership attractive.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the UK elections and Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process. Courtesy: JPM & Commerzbank

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data