The FOMC is also scheduled for this week but is expected to be overshadowed by fiscal negotiations. There is some possibility that the Fed could lengthen the duration of its purchases at this meeting, but the key FOMC meeting will be in September when it unveils its framework review and thus will be the more likely forum to make policy changes on forward guidance and asset purchases.

Given these cyclical and political risks, the expectation is that the USD weakness is likely to continue selectively. Within G10, the euro bloc ex-GBP remains the primary candidate for such trades.

In the UK, PM Johnson warned a ‘second wave’ of Covid-19 cases has started in Europe and it was revealed that travellers to Belgium, Luxembourg and Croatia face quarantine measures on return to the UK. The International Air Transport Association was reported as not seeing global air travel returning to pre-Covid-19 levels until at least 2024.

Ahead of the Fed announcement, today’s data releases seem unlikely to have much impact on markets. The Bank of England’s June data for bank lending is likely to note a pickup as lockdown restrictions were eased. In particular, mortgage approvals are forecast to have risen sharply.

OTC Updates & Options Strategy:

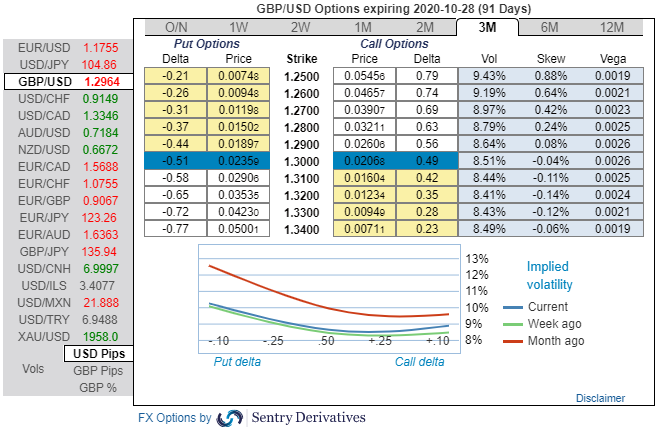

Options Strategy, Diagonal Debit Put Spread (DDPS): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling: Stay short a 2M/2W GBPUSD put spread (1.3075/1.25), spot reference: 1.2962 level.

The Rationale: Observe the 3m GBP’s positive skewness that has stretched towards OTM Put strikes upto 1.25 levels, hence, options traders are expecting that the underlying spot FX to slide southwards.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run. One can observe fresh negative bids that indicates hedgers have shown renewed interests for bearish risks in the months to come.

Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Sentry, Saxo & Lloyds

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges