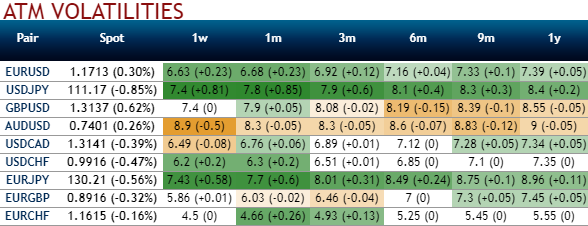

The valuation of FX derivative securities significantly depends on the market participants’ expectation of future volatility. Thus implied volatility often garners as much attention as the option price in option listings, and estimation of future volatility is a critical aspect of market research.

Please be noted that the above-implied volatilities are the prices (in volatility terms) for the most liquidly quoted forex option contracts. Significant changes can indicate a change in market expectation of future variability in the underlying forex spot market.

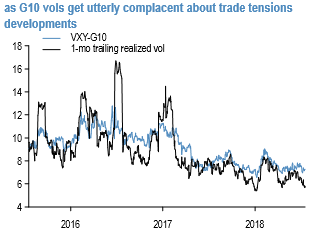

The FX market continued to react modestly to the lingering trade tensions while broadly underperforming G10 realized vol sank the front end FX vols (refer this chart).

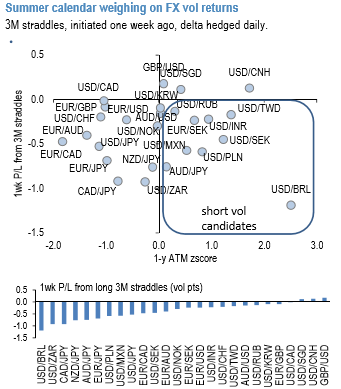

The summer calendar is certainly banging on that door. Notable exceptions are CNY and GBP. The broad underperformance masks EM – G10 vol chasm that widened beyond 2015, 2016 highs and is now the widest since 2009 in 3M tenor (refer below chart).

EM vols extended higher on the back of the trade frictions headlines (the latest one suggesting President Trump being "ready to go to" imposing tariffs on $500billion of imports from China) and as Brazil election pricing bounced higher while G10 vols came under pressure from soft realized vols that are back to near the YTD lows (Refer below chart).

Risk premium: Implied minus realized volatility. A positive risk premium means implied volatility trades above realized volatility, i.e. the implied volatility can be seen as “rich”.

While EM-G10 divergence seems optically vulnerable to a reversal a degree of caution in the current market is prudent and we are selective and defensive in fading the viable pockets of still relatively rich FX vols. While Turkish lira among the weakest EM currencies, TRY now showing signs of strength. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 35 (which is bullish), while USD is flashing at -176 (bearish) while articulating at 12:40 GMT.

For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data