Gold lost its shine after Trump’s tariff announcement. It hit an all-time high at $3167 and is currently trading around $3027.

Safe Haven No More: Recession Fears Trigger Gold Sell-Off

Gold prices fell recently from historic highs to a three-and-a-half-week low of around $3,027.90 an ounce as of April 7, 2025, following Donald Trump's threat of retaliatory tariffs. While the original rise in trade tensions caused uncertainty in the market, the exclusion of precious metals from the tariffs and profit-taking following a year's rise in gold prices of 35% resulted in the fall.

Despite gold's traditional role as a safe-haven asset during economic uncertainty, investors are currently selling gold to offset losses elsewhere in the markets in a broader sell-off in response to recession fears fueled by the trade war. Although analysts anticipate potential volatility and some forecast a sharp decline on account of increased supply and poor demand, big financial institutions are still optimistic regarding the long-term prospects for gold.

According to the CME Fed Watch tool, the chances of a 50 bpbs rate cut on the June 18th 2025 meeting have increased to 51.70% from 9.8% a week ago.

Technical Analysis: Key Levels and Trading Strategy

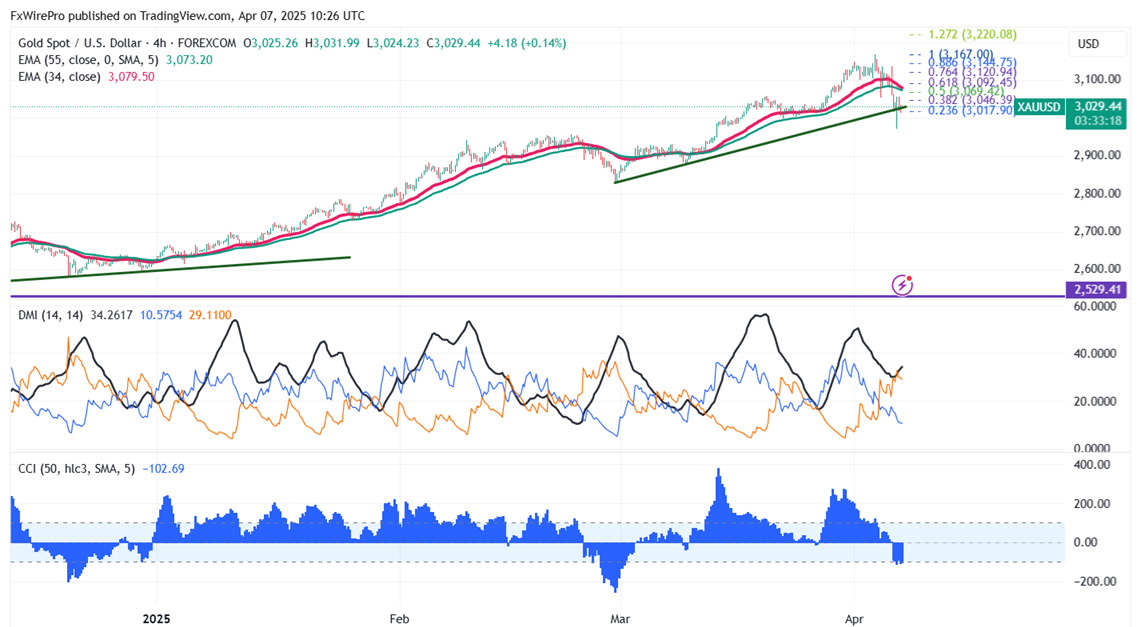

Gold prices are holding above short term moving average 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4 hour chart. Immediate support is at $2970 and a break below this level will drag the yellow metal to $2956/$2920/$2900/$2880. The near-term resistance is at $3060 with potential price targets at $3070/$3100/$3167/$3200/$3255.

It is good to sell on rallies around $3058-60 with a stop-loss at $3100 for a target price of $2835.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate