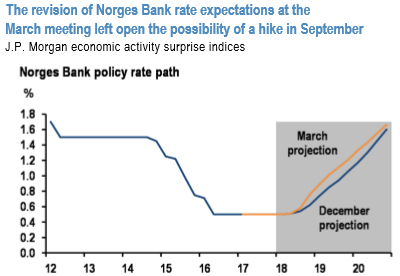

Norwegian krona bulls have received a fillip over the past two weeks from a hawkish re-assessment of the central bank’s rate track and a sharp rally in oil prices. The Norges Bank signaled at its March meeting that policy rates would rise earlier than 1Q’19 as had been previously assumed (refer 1st chart), which in our economist’s view is consistent with a first hike in September.

The central bank has revised up its policy rate profile by 15bp and 6bp for the end of 2019 and 2020, even though it has taken down its CPI forecast by 0.16%pts and 0.33%pts for those horizons, indicating a real policy rate that is effectively 31bp and 48 bp higher for the end 2019 and 2020, respectively. This puts the Norges Bank in sharp contrast with most other G10 central banks that have adopted a more dovish tone.

In addition, Brent also rallied $5/bbl this week in part on supportive inventory data and partly on geopolitical concerns relating to US' commitment to the Iran nuclear deal. Please be noted that odds of production curbs continuing beyond June have increased with OPEC considering a technical change of using 7-yr average inventory levels instead of the current 5-yr to benchmark progress on supply re-balancing, which would result in current stocks looking appreciably above target and in need of further reduction.

We took part profit on our long NOKSEK position in cash after last week’s Norges Bank fueled rally, but remain in short EURNOK cash and a NOKSEK vs EURSEK option switch to milk the residual cheapness in the cross that screens a couple of points cheap relative to contemporaneous interest rate and energy price drivers even after this year’s run-up (refer 2nd chart). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices