The Indian rupee continued to drag its initial losses to Rs 66.85 against the US dollar in late morning deals on sustained bouts of dollar demand by importers and banks amid lower local equities. The domestic currency opened lower by 66.80 as against yesterday's closing level of 66.71 per dollar at the Interbank Foreign Exchange (Forex) market.

INR vols sliding to record lows are inviting conditional spread trades INR vols are collapsing to all-time lows, driven by remarkably sideways price action in spot for the best part of the year.

We call for a continuation of this pattern of subdued spot regime, as portfolio inflows have returned, the FCNR deposit redemptions are far from causing the price swings that some had feared, and the currency is fairly insulated from US elections fallouts in terms of trade tensions.

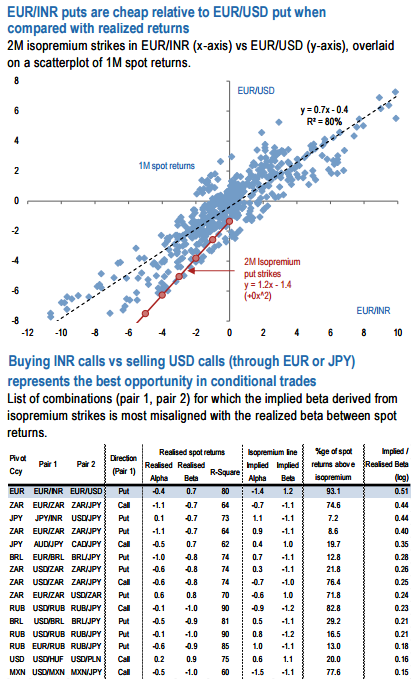

This suggests that the case for buying outright USDINR vol is not straightforward – in fact, we sold 3M ATM to fund our long EURINR vega as explained above. In directional space, the cheapness in EURINR vols is now standing out relative to EURUSD, given the tight correlation between the two pairs.

Thus, while the realized beta between EURINR and EURUSD returns is 0.7, the implied beta derived from isopremium put strikes is much steeper at 1.24 (see above chart), thanks to this combination of low vols and steeper FX carry.

In fact, INR calls vs USD calls are a standout combination on a ranking of such conditional trades (see above table), and a similar pattern exists between cheap INRJPY calls vs rich USDJPY calls.

Hence, we advocate initiating longs in a 2M EURINR 73 put, funded by shorting a 1M EURUSD 1.0850 put, in equal EUR notionals. The strike in EURUSD is chosen in a slightly aggressive so as to return a positive premium inception, which we will lock in in the base case scenario where both legs expire out of the money.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch