Gold has continued to sense buying price sentiments.

The major driving forces of bullish scenarios of gold prices:

The US Fed has confirmed last night what they had already signaled in January, by maintaining status quo in its monetary policy, we wouldn’t expect any rate hikes until 2020 after it has said it will be “patient” in rate normalization and will remain “flexible” in its asset-reduction programme.

The Fed’s U-turn from its hawkish stance just a month ago caught the market by surprise, resulting in a sharp gold rally.

Trade tensions are still imminent even though a sudden constructive development in the US-China trade talks or a prolonged series of positive macroeconomic data, unclear Brexit directions and a series of poor global PMIs add fuel to gold’s ascent.

Technically, Gold’s (XAUUSD price) continue to spike especially after dragonfly doji formations at $1,287.09 and $1,285.39 levels respectively (on daily plotting). Consequently, bulls have taken-off rallies above 7 & 21-DMAs. Ever since the formation of hammer pattern at $1,200.55 levels in Aug’2018 (exactly at double top neckline, refer monthly plotting) we’ve seen more than 9.5% more upswings so far, while the momentum indicators substantiate bullish sentiment on this timeframe. We see little in the way to halt gold’s push for $1,350/oz, we upgrade our short-medium term outlook on gold to bullish.

Bullion Market’s OTC Indications:

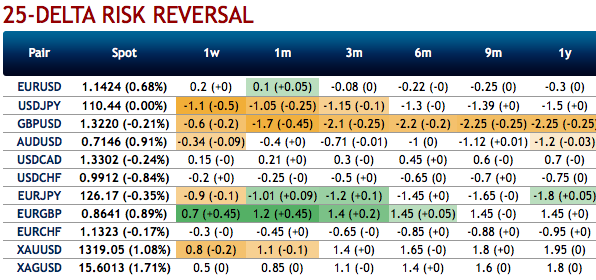

Please be noted that the positively skewed IVs of 2m XAUUSD contracts are showing bids for OTM calls that indicates the upside risks.

One could see fresh negative bids in the existing bullish risk reversal setup. To substantiate the above bullish sentiment, risk reversal (RRs) numbers indicate an overall bullish environment.

The above risk reversal numbers have been known as a gauge of the underlying market’s hedging opportunities for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Option Strategy: Contemplating the minor dips in the short-run and OTC indications, capitalizing prevailing negative RR bids of gold, we advocate longs in gold via ITM call options.

Buy 2m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for April’19 delivery as we could foresee more upside risks. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR is at 21 (mildly bullish), the hourly USD spot index is inching towards -50 levels (bearish) while articulating at 12:29 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis