GBP had not rallied even though the subjective probability of a disruptive no-deal Brexit had receded materially over the prior month. This anomaly was corrected with a vengeance in January as GBP rallied by a chunky of 4.5%. But having first undershot in response to favourable developments around the risk of no-deal, it appeared to us that GBP was in danger of over-reacting and was moving from merely removing the negative tail-risk of no-deal, which we estimate to be worth about 3% to GBP’s probability-weighted value, to beginning to price a materially higher probability of no-Brexit. This was premature, in our view, and the subsequent 1.5% correction lower in GBP tends to support such an assessment.

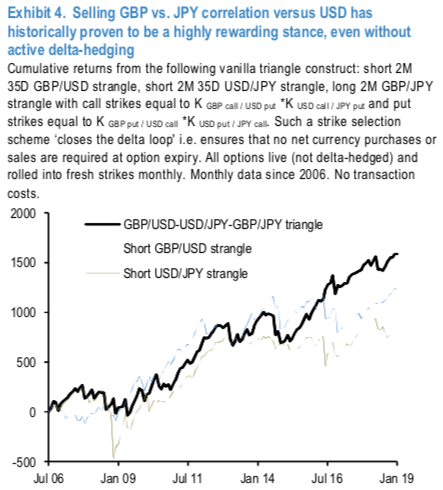

The one pushback against selling GBP vs. JPY correlation at the current market is value, or rather the lack thereof. Implied corrs have already subsided 15% pts. from their local December peak to near 2-yr lows and carry only thin premium over trailing realized corrs. Within the GBP-cross universe, somewhat better value resides in GBPAUD options where nominal implied corrs. are 15-20 pts. higher, and which also incidentally ranks second next only to GBPJPY on long-horizon risk-return metrics from corr. selling in Exhibit 5 (highlighted in blue).

Unlike GBPJPY however, GBPAUD is not a symmetrically profitable triangle play in calls and puts: Exhibit 5 suggests that owning GBP calls/AUD puts (against selling GBPUSD calls and AUDUSD puts) significantly outperforms owning GBP puts/AUD calls, presumably on account of GBPAUD’s traditional anti-risk sensitivity on the upside (i.e. spot tends to rally sharply in crashes).

Fortunately, this directional preference suits current tactically bullish GBP views to a tee, hence GBP call/AUD put spreads financed with AUD put/USD call spreads is a viable alternative to our GBPJPY – USDJPY call spread switch for expressing a constructive view on Brexit negotiation outcomes. Sterling appears to be turbulent in the weeks to come, we run you through hedging scenarios of Brexit risks in our upcoming post. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -92 levels (which is bearish), hourly USD is at -4 (neutral), hourly JPY spot index was at 103 (bullish) and hourly AUD is 136 (bullish) while articulating at (12:07 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch