ECB is scheduled for their monetary policy this week, with the EURUSD continuing to stand above 1.11 ahead of Thursday’s ECB monetary policy meeting, the European central bank is all set to publish details on the allocation of its PEPP programme and focus will be on the potential skew towards Italian and French government bond holdings.

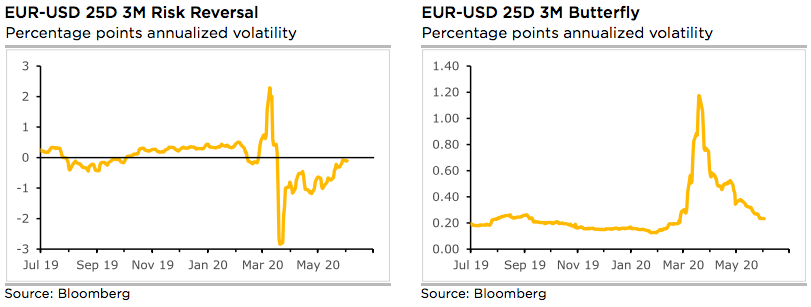

EURUSD risk reversals are trading positively again for tenors below 3-months, and at almost zero for 3-months (refer left part of chart 1). Because the dollar is less suited as a safe haven? Perhaps marginally. Above all because the market is considering the risk of a second wave of the pandemic to be low and considers a major, risk-driven slide in EURUSD to be less likely. Otherwise butterflies would not be virtually back at pre-corona levels (right part of chart 1). That might be sensible pricing levels for all those market participants who can spread their risks. Anyone not able to enjoy that luxury might be pleased about this good opportunity to hedge non-diversified risks against a renewed wave of risk aversion.

EUR risk reversals have still been indicating the hedging sentiments for the bearish risks in the long run, as the fresh negative bids are added to the positive RRs for 1-3m tenors (2nd diagram).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer 3rd diagram), while IVs are shrunk below 6.5% across all the tenors.

Hence, considering all these factors, the below options strategies are advocated.

Options Strategy: Contemplating above factors, activated 1m butterfly spread on trading grounds. Initiated longs in 1m OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy 1m OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as EURUSD is perceived to have a low volatility.Courtesy: Sentry, Saxo & Commerzbank

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data