The Reserve Bank of Australia (RBA) left its key rate unchanged today. The Australian dollar was able to benefit slightly from this decision as the majority of analysts had expected a rate cut.

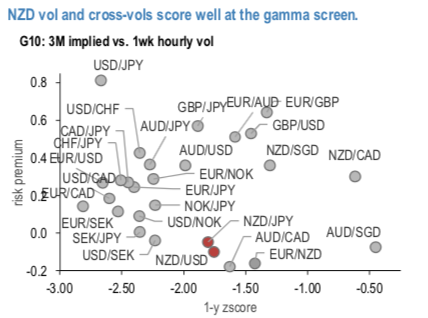

While the RBNZ surprised markets last month adopting an explicit easing bias. The shift caused oversensitivity to data prints. With a busy calendar ahead of us we think it is prudent to add defensive gamma in idiosyncratically troubled currencies such as NZD and AUD to short vol portfolios.

In addition to the usual daily realized vol (and exponentially weighted vol – e.g. see here) we also track high frequency, short term, realized vol (hourly) in order to gauge persistency of the realized vol trends as well as for spotting major shifts (refer 1stchart).

The 2ndchart analyses options event risk pricing (overnights break-evens) with respect to the observed 1-day spot moves. It shows that pricing of the major data prints exhibited fat right tails during the last 3 months, i.e. it is worth being long gamma over the events. We hypothesize that such dynamics are going to persist. However, such gains are short-lived and not enough to offset the time decay over longer periods.

The long term performance of the delta-hedged 2M straddles in NZDUSD, NZDJPY and EURNZD tend to succumb to decay (refer 3rdchart). Absent broad-based change in risk sentiment, gamma spikes are likely to continue being short lived and with limited impact on vega tenors. That is supportive of constructing calendar structures. With a P/L beta of about 50% of the outright long gamma, vega neutral (and delta-hedged) calendars are better suited for playing long event risk. The structure exhibits minimal or no decay while providing long gamma exposure.

The recent heightened sensitivity to the data prints (as witnessed following the Wednesday CPI data print) warranties solid AUD gamma performance, which makes us comfortable expressing the below structures equivalently in AUD as well.

Trade recommendations:

We recommend below options strategies contemplating above driving forces:

Buy 2M NZDUSD straddle 7.85/8.2 vs. sell 9M 25D strangle @8.6ch, in vega neutral notionals, delta-hedged

Buy 3M NZDJPY straddle 8.9/9.2 vs. sell 9M 25D strangle @10.10ch, in vega neutral notionals, delta-hedged. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 34 levels (which is bullish), while hourly NZD spot index was at -58 (bearish), while articulating (at 06:51 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence