The Bank of Japan (BoJ) got its Christmas presents firstly on 8th November and now again on 14th December: since the US Presidential elections the yen has been under pressure against USD. Thanks to Trump. As a result, the BoJ can be a little more relaxed when facing the next round of ugly inflation data tomorrow.

It will stick to the control of the yield curve for the foreseeable future, which means getting the Fed to do its work for it. Does that make it any more likely that it will reach its inflation target? Hardly, but at least it eases the pressure on the BoJ.

In yesterday’s Fed’s meeting (14th Dec), as broadly anticipated, the FOMC was upbeat and more hawkish than anticipated. Yes, the FOMC raises the target range of the fed funds rate by 25bps − the first rate hike since December 2015.

Most importantly, after a prolonged duration of downgrades to the dot plot, the FOMC modestly tweaked up the profile. Three 25bps hikes are now expected in 2017, up from two.

OTC outlook:

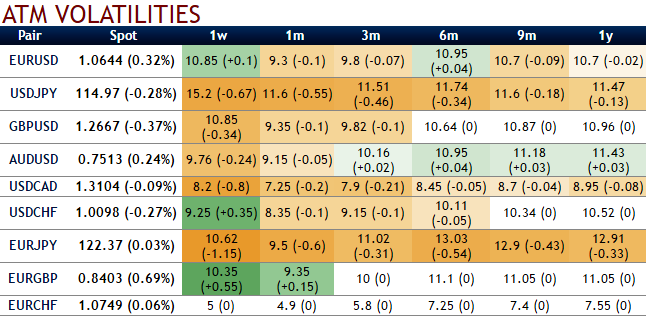

Yen vols were a marked outperformer this year as USDJPY shed nearly 17% peak-to-trough, but this is likely to change going forward under the aegis of the BoJ’s yield curve control framework that has worked to anchor JGB yields better than we expected, and as the pair encounters offsetting forces of higher US-Japan rate differentials and greater risk-aversion from EM weakness.

USDJPY risk-reversals: As a result of the above fundamental developments, the hedgers of USDJPY began bidding OTM call strikes as you could see positive changes in risk-reversals. But these numbers in longer tenors are still very much a work in progress as far as vol selling opportunities go, with current levels (3M risk reversals at shy above 11.5 vols & with increased pace in 6m vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), while 3m IV skews to substantiate bearish hedging offered by risk reversals. But short-term risks reversal bets signals the higher potential of USD.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

Hence, contemplating above risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

From positive risk reversal flashes you can probably figure out hedging operations for upside risks in both in short run and long run are intensive, while 1m IV skews also signify the hedging interests in OTM call strikes.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty