The zloty has benefitted over the past month as regional inflation data have surprised to the upside: the market is aware that the Polish MPC is well balanced, with a fair proportion of hawks warning already that the central bank should not fall behind the curve as inflation expectations begin to rise.

In this context, the latest behavior of retail fuel prices is indicative: weekly data show sharp increases in gasoline price through February, with the cumulative gain working out to around 2.1% MoM.

This would imply around 20% YoY rise in the fuel component of CPI during February, which would add 1pp to headline CPI inflation.

Inflation has accelerated sharply over the past quarter and core inflation, too, has ended its stint in negative territory -- hence, this could become a crucial turning point in NBP's monetary stance.

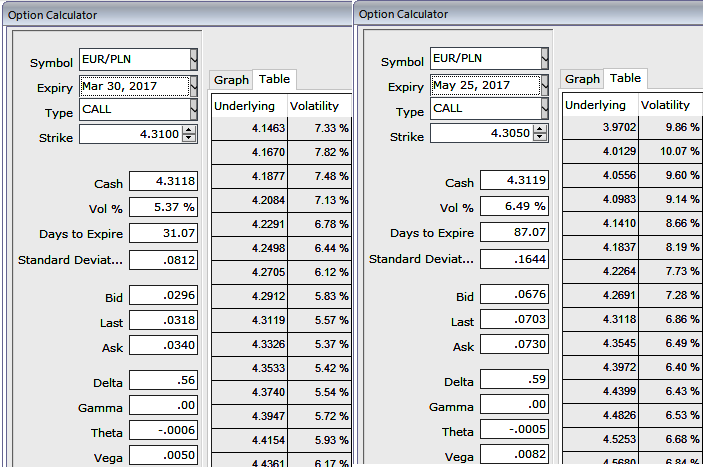

Please be noted that the implied vols of this pair has been very tepid, just shy above 5.35% and a tad below 6.5% for 1 and 3 month tenors, consequently, the ATM calls are not advisable as the zloty may continue to gain and hawks are evident in warning already that the central bank should not fall behind

On the flip side, contemplating Fed’s hiking cycle in mind, we advocate initiating longs in 3m EURPLN 1x1 call spread (4.45, 4.60), spot ref: 4.3150.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says