Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale.

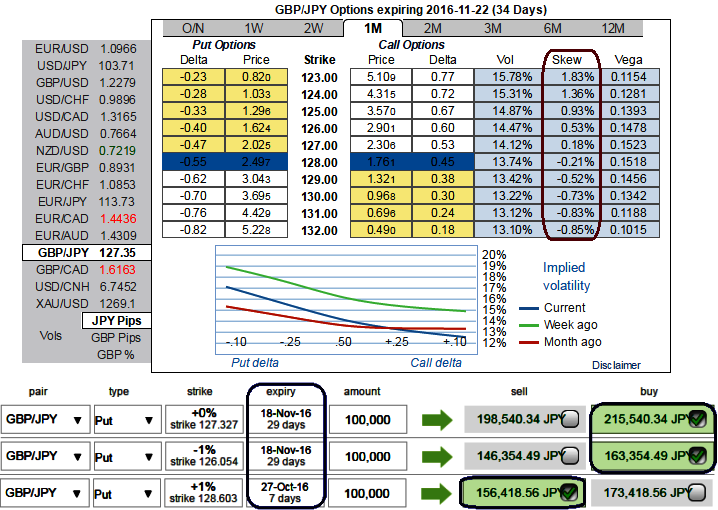

Please be noted that the 1m GBPJPY IV skews are more biased towards OTM put strikes.

From the IV nutshell one can understand that the negatively skewed IVs in 1m contracts would imply that the underlying spot FX is less likely to remain in ITM territory or in other words spot FX would shift towards OTM strikes.

Hence, writing such less favourable options would cushion the cost of any downside hedging strategies. For an instance, as shown in the diagram, using a narrowed expiry (1%) ITM shorts would reduce the cost of 2 lots of longs in ATM and OTM puts.

The significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

As shown in the diagram, 1m tenor has successively rising IVs above 14% which is on higher side, since the spot Fx of underlying pair is rising along with IVs, this is good news for option writers as such options with a higher IV costs more. Thereby, writers are likely to receive more premiums.

The traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

Well, on the contrary, if the same IV during longer tenors keep increasing and you are holding an option, this is good for holders as well. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

There was also a valuation issue at play, in that yen vols had lagged the sharp collapse in VXY prior to BoJ –held up in all likelihood by the outside chance of a policy regime shift in Japan –and were ripe for a sell-off if the meeting proved uneventful.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty