Both minor and major trends of EURNZD has been in bullish amid mild hiccups in the interim trend, the pair has vigorously extended its upside potential beyond 1.6714 levels after surpassing 1.6546 levels on RBNZ’s monetary policy today, and in the wake of the dovish ECB shift and mixed EZ economic data. The next big event is the ECB on 10 April.

In the medium term perspective, the ECB has delayed plans to hike rates and instead initiated further stimulus in the form of cheap bank loans. We target 1.6714 by the end of Q3’2019.

On the flips side, The Reserve Bank has surprised us by shifting to an easing bias for the OCR. The RBNZ is now saying that "the more likely direction of the next OCR move is down." It also said that the balance of risks to the economic outlook "has shifted to the downside." This is very different to February when the RBNZ said the next move could be "up or down" and that there were "both upside and downside risks."

With only a few paragraphs to go on, it is difficult to discern exactly how serious the RBNZ is about cutting the OCR. The additional spanner in the works is that a committee will take over the decision making from 1 April, and the committee could choose a different stance. But clearly, the odds of an OCR reduction this year have increased.

We were very surprised by this change of stance because the economic situation has not changed much since the RBNZ's last missive in February. Perhaps the main reason for the change of stance was the actions of other central banks.

On a broader perspective, RBNZ’s shift in OCR rate disappointed NZD with unchanged guidance. Tomorrow, we get to hear more from RBNZ Gov. Orr about the new monetary policy regime.

OTC outlook and Hedging Strategy:

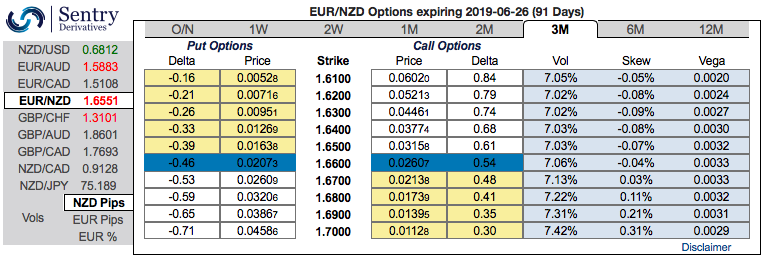

Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests in the upside risks (refer above nutshell). Bids for OTM calls strikes up to 1.68 levels are observed ahead of RBNZ monetary policy.

Contemplating all the above factors, we could foresee the upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Alternatively, as we could foresee upside risks in the weeks to come, ahead of RBNZ’s monetary policy this week on hedging grounds, we advocate initiating longs in EURNZD futures contracts of mid-month tenors with a view to arresting further upside risks. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -95 levels (which is bearish), while hourly NZD spot index was at -95 (bearish) while articulating (at 10:16 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated