Among the three EM currencies, MXN performed the best with a net buy of USD0.9bn by leveraged funds to take the overall position to a net long of USD0.1bn, the first time of MXN long since November 2015.

Leveraged funds remained net longs in BRL (USD0.5bn) and RUB (USD0.1bn) with marginal trimmings in net longs over the week.

We recommend hedging RUB expenses via FX forwards, and incomes via FX forwards.

Alternatively, at spot ref. 66.6786: we also recommend either going long in 2m/1w diagonal USD/RUB put spread or shorts in near month futures, but the oil and RUB recovery now look too extended for a put position vs. the USD as from current levels we see only contained further potential for RUB gains.

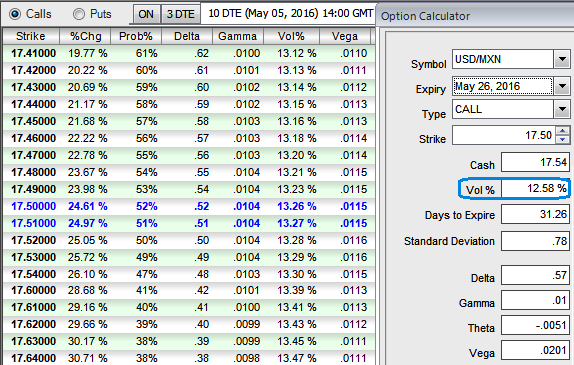

On the other hand, MXN among few EM currency space typically held in carry basket seem cheap on a real effective exchange rate basis, sell 1M USD/MXN ATM calls vs buy 6M OTM delta calls, use European style options.

1M ATM implied volatility of USDMXN is perceived to be at 12.70% and it is likely to inch higher in long run (for next 6 months to 1-year span).

Hence, last week we had advocated shorting 1W (1%) OTM put option which is now favoured by ongoing upswings to reduce the cost of hedging by financing long position in buying 1M ITM +0.51 delta put option at net debit to enter into this position.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?