NZDUSD speculators have begun paring extreme short positions, indicating NZD upside potential near-term. However, there is major event risk to navigate during the next week.

The catalyst for the reduction in short positions has been the improved mood in risky asset markets over the past two weeks (e.g. equities higher, US dollar lower). Today’s strong NZ GDP data will add to arguments for exiting shorts, and we would not be surprised to see the NZD trading at 0.6725 during the week ahead.

OTC Outlook and Options Strategy (NZDUSD):

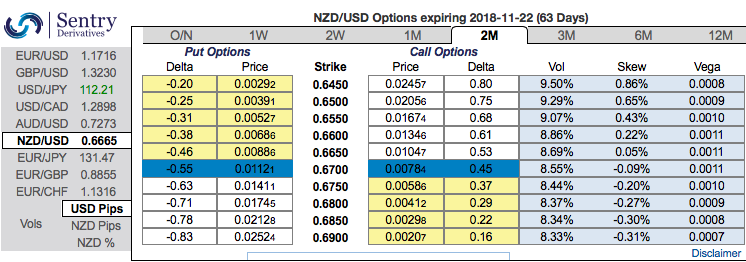

Most importantly, OTC market hedging sentiments still favor bears as the positively skewed IVs of 2m tenors signify the hedgers’ interests for downside risks. The bids have stretched for OTM put strikes upto 0.6450 levels (above nutshell).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the deep in the money call with a very strong delta would move in tandem with the underlying move. Deep in the money call with a very strong delta will move in tandem with the underlying.

Considering ongoing price rallies of kiwi dollar, it is wise to capitalize on such deceptive rallies and execute below options strategy:

Add longs in 2 lots of 2m (1%) in the money delta put options and short 2w (1%) out of the money put options.Thereby, the strategy addresses both upswings that are prevailing in short run and bearish risks in the long run by delta longs.

Currency Strength Index: FxWirePro's hourly NZD is inching at 155 (which is bullish), USD spot index is flashing at -99 levels (which is bearish), while articulating (at 10:59 GMT). For more details on the index, please refer below weblink:

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes