Japanese Manufacturing:

The latest survey data signalled a slight improvement in operating conditions at Japanese manufacturers. Production rose for the second consecutive month, while total new orders declined at the weakest rate in the current eight-month sequence of contraction. International demand also increased for the first time since the start of 2016.

Most notably, the new exports orders rise for the first time in eight months.

It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases. Any figure greater than 50.0 indicates the overall improvement of sector operating conditions. The headline PMI posted at 50.4 in September, up from 49.5 in August and signalling a modest improvement in manufacturing conditions. Moreover, the latest reading was the highest since January and broadly in line with the long-run average (50.6).

OTC outlook and hedging framework:

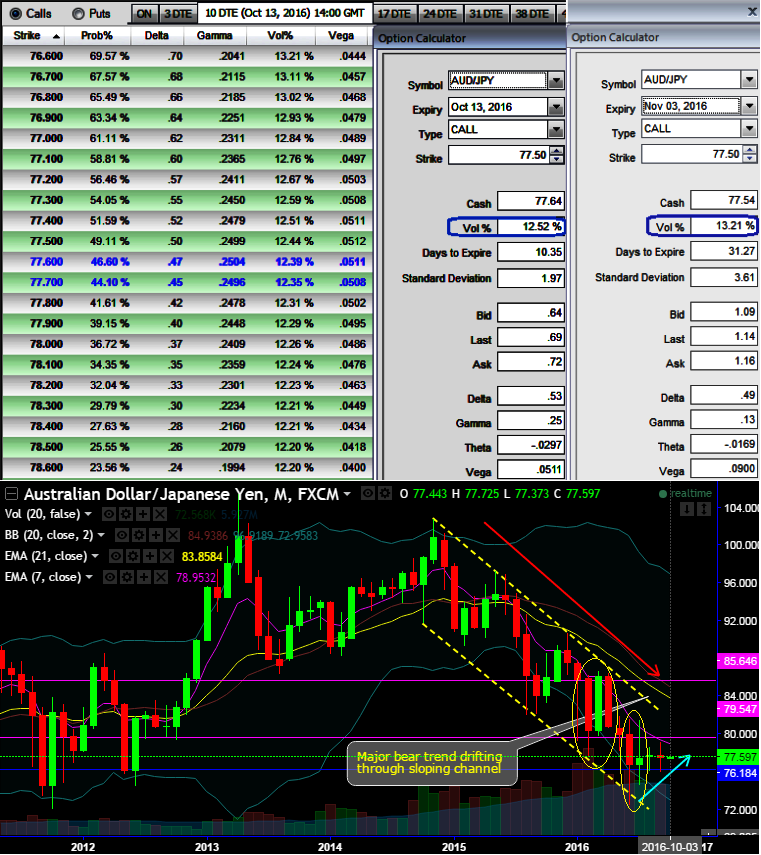

We believe ongoing AUDJPY upswings move in sync with 1w ATM IVs - rallies and HY vols likely to favour PRBS.

This pair has been oscillating between 76.739 and 76.065 levels, showing mild upswings but long term declining trend seems to be intact as you can see the convincing volumes and technical indicators favouring bears on the monthly charts.

ATM IVs of AUDJPY is rising a shy above 12.5% as shown in the diagram the standard deviation these call option is flashing up at 1.97. While IVs of ATM contracts of 1m tenors are spiking crazily at 13.21%, this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 16% and it is quite higher side when long-term trend is bearish and spikes in previous rallies for short term which is a good sign for option writers.

Since the spot Fx of the underlying pair is rising along with IVs from last couple days, this is good news for option writers as such options with a higher IV costs more. Thereby, writers are likely to receive more premiums.

Well, on the contrary, if the same IV during longer tenors keep increasing and you are holding an option, this is good for holders as well. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 1 lot of at the money -0.51 delta put, 2M 1 lot of (1%) out of the money -0.35 delta put and sell 2W one lot of (1%) In-The-Money put option using prevailing rallies.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch