In recent months, JPY has been one of the outperformers. The JPY appreciation was considerable in the Q2, mainly due to deterioration in 5 risk sentiments as concerns for an escalation of trade wars between the US and China strengthened. USDJPY fell below 110-level on May 8thfor the first time since late March this year.

Given the JPY appreciation with unexpected deleveraging and some other developments discussed in the following, we are making modest -10 changes to our USDJPY forecast.

As mentioned above, there have been some developments for the past month. The most important event was that US-China relationship deteriorated with a possible raise of US tariffs on $200bn worth of imports from China to 25% from 10%, and this led to the deterioration in risk sentiments. This was a shock to the markets as shared consensus was that their talks were making progress and they were not too far from an agreement. As a result, JPY appreciated. The sudden change in the US attitude towards China and its stronger protectionist stance suggests risks with which the US might go hard on Japan in their trade talks. The looming risks are likely to weigh on USDJPY for the next coming months.

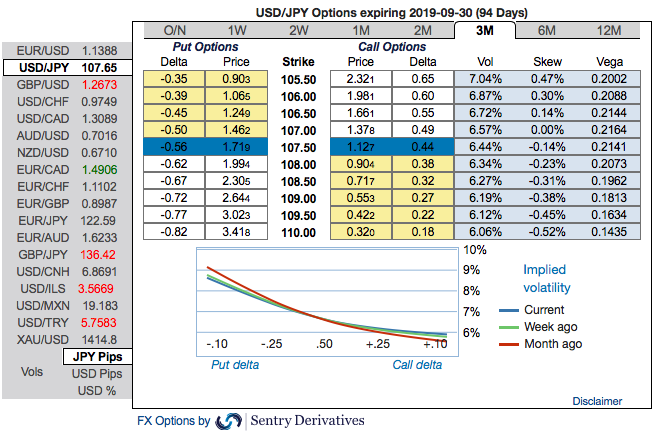

USDJPY OTC update and options strategy as follows:

Please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 105.50 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Hence, at spot reference of USDJPY: 107.650 levels, we advocate buying a 2M/2w 109.732/105.50 put spread ahead of Fed and BoJ monetary policies (vols 6.61 vs 6,89 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Hence, the above strategy seems to be the best suitable in prevailing volatile conditions. Courtesy: JMP, Sentry & Saxo

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -52 levels (which is bearish), while hourly USD spot index was at -6 (neutral) while articulating at (10:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis