Sterling markets were focused on the Bank of England today, but BoE hints on downside risks in sterling on conditional basis of Brexit event.

To substantiate, we would foresee GBP on weaker side on BoE's alerts of the economic risks if Britain votes to leave the European Union, saying on Thursday that sterling could tumble harshly and unemployment would probably rise. The central bank sends this caution of this event risk after leaving their bank rates unchanged at 0.50%.

The dovish tone could have been letting the recognizable cat out of the bag and send Sterling into a tailspin and perhaps the smart money has been gearing up to such an event.

However, firm sentiment deteriorated in UK noticeably in April and is likely to worsen further as the EU referendum draws nearer, supporting our expectation of zero growth in Q2 16.

Don’t dare to forget the recent UK PMIs for all sectors that have deteriorated considerably.

Manufacturing PMI – Decline from previous flash of 50.7 to the current 49.2; Construction PMI – Decline from previous flash of 54.2 to the current 52.0; Service PMI – Decline from previous prints of 53.7 to the current 52.3. While, Preliminary GDP (q/q) has been narrowed down to 0.4% from previous 0.6%. These numbers are actual the leading indicators of economic health.

To justify our stance, The BoE forecast Britain's economy would grow 2.0% this year and 2.3% in 2017, down from forecasts of 2.2% and 2.4% in February.

In two years' time, inflation is forecasted to reach a fraction over its 2% projections, essentially unchanged from the forecast in February.

Hedging Frameworks:

The likelihood of the significant 'brexit' will likely keep adding pressures on the UK currency through the foreseeable future, while key events in the week ahead could force significant short-term volatility.

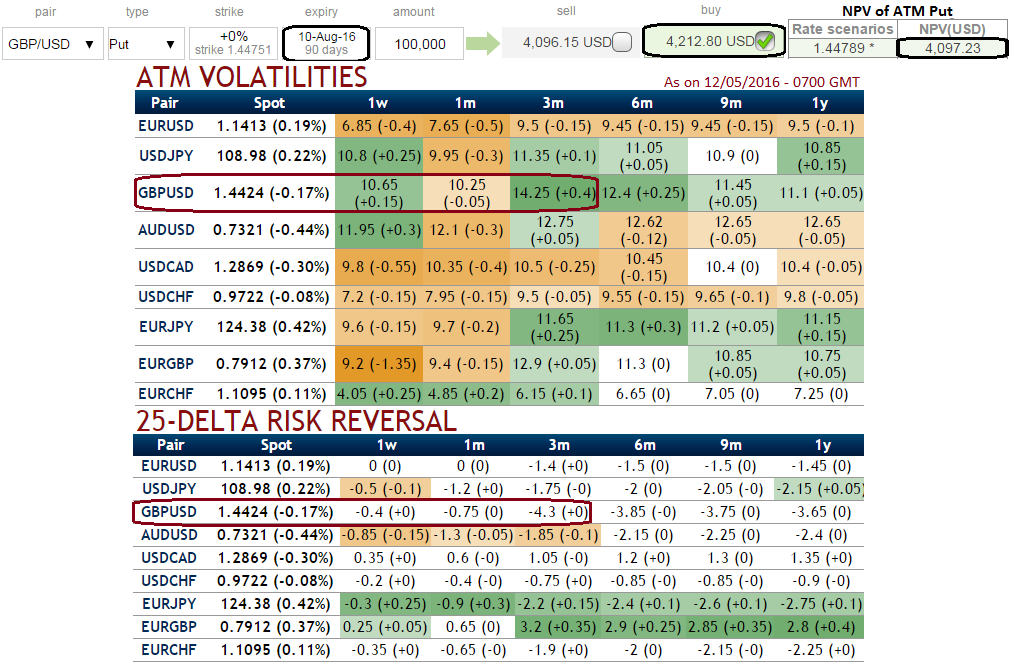

At spot FX reference at 1.4471, it is advisable to bid 3M risk reversals and stay hedged to mitigate downside risks as we anticipate more dips extending up to 1.40 levels in next 3 months or so and it is understood that bearish momentum is bolstering as we saw that from delta risk reversal table in our recent write up as well, bears have been willing to pay higher premiums. Hence, aggressive bears can initiate strategy using ATM puts.

Long side: 2M at the money -0.49 delta puts, 3M (0.5%) out of the money -0.27 delta put

Short side: 1W (1%) in the money put options are recommended to cushion the hedging cost.

The strategy would be constructed for net debit but reducing debit, narrow expiries are the most essential to ensure the short side expire worthless.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022