Ichimoku analysis (Daily chart)

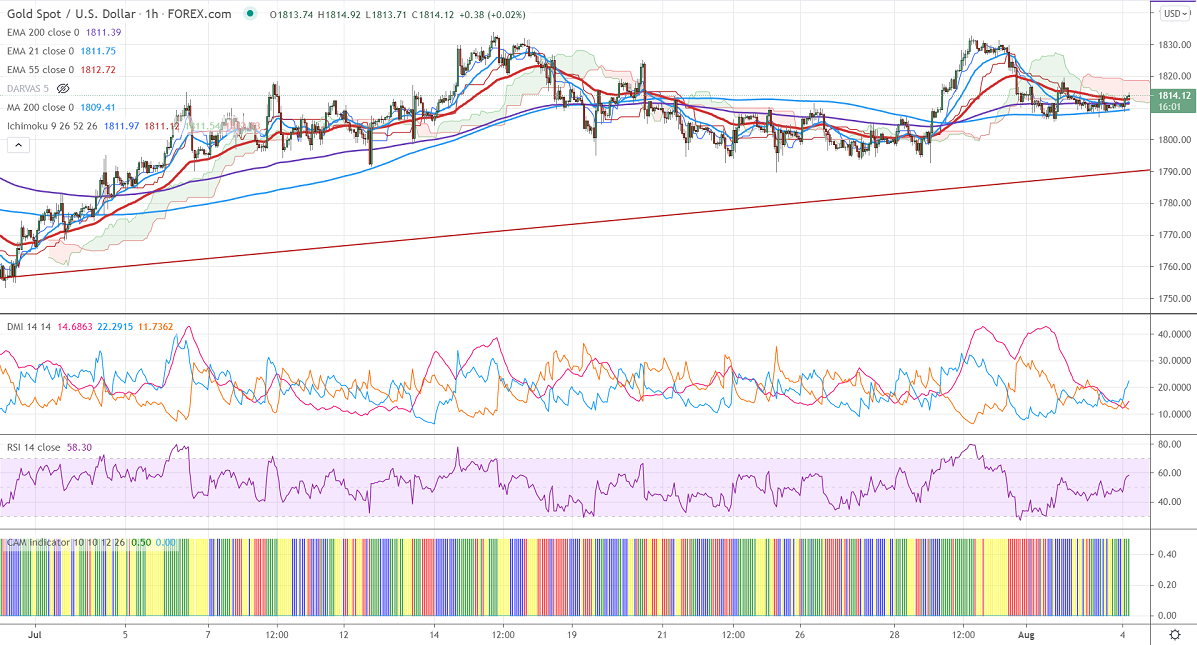

Tenken-Sen- $1811.46

Kijun-Sen- $1811.12

Gold lacks conviction and trading between $1790 and $1832 for the past week. The yellow surged to $1832 immediately after the dovish fed monetary policy. The jump in coronavirus cases and declining bond yields are preventing the yellow metal from further decline. The US dollar index is hovering near the 92 levels. It should cross the 92.20 level for intraday bullishness. Markets eye US ADP employment data for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- weak (positive for gold)

Technical:

It is facing strong support at $1790, violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1821 and a convincing break above will take the yellow metal $1835/$1860/$1900 is possible.

It is good to buy on dips around $1790-91 with SL around $1778 for TP of $1850