Gold -

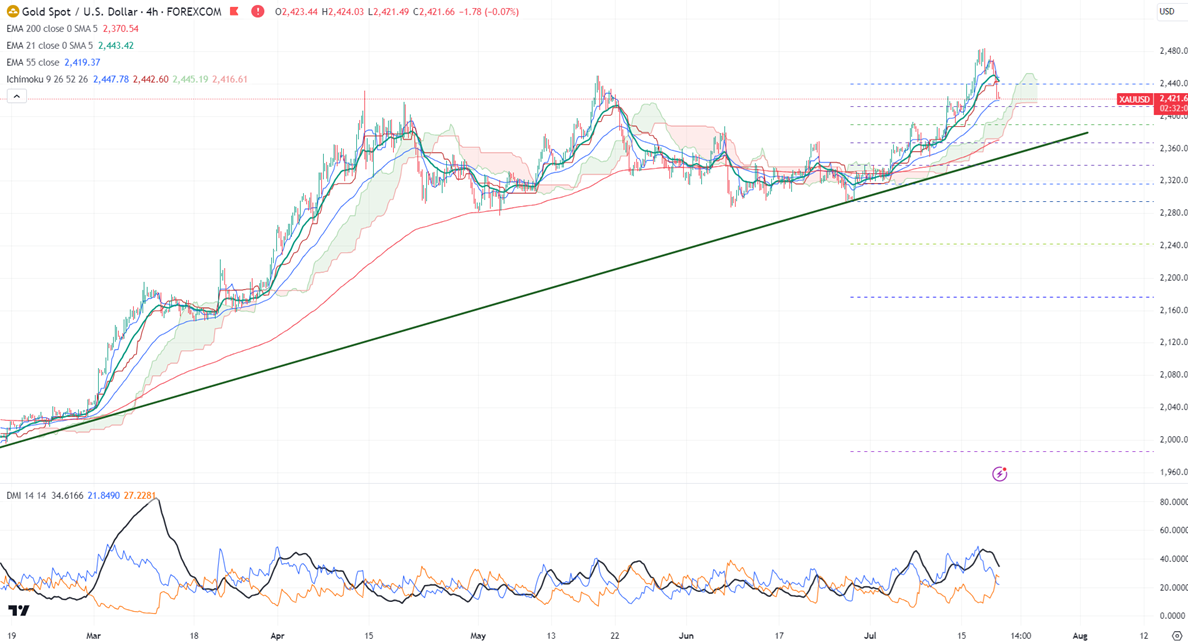

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2447

Kijun-Sen- $2442

Gold continues to trade weak for the second consecutive day on weak US jobs data. It hit a low of $2420 at the time of writing and is currently trading around $2421.

US economic data

US jobless claims - weak (positive for gold)

US Philly fed - positive (negative for gold)

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 91.70% from 85.10% a week ago.

US dollar index- Bearish. Minor support around 103.60/103. The near-term resistance is 104.20/105.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $2420, a break below the target of $2410/$2385. The yellow metal faces minor resistance around $2435 and a breach above will take it to the next level of $2450/$2475/$2480.

It is good to buy on dips around $2400 with an SL of around $2385 for a TP of $2500.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty