FxWirePro- GBPJPY Daily Outlook

GBPJPY pared most of its gains made this week on the weak pound sterling. It hits a low of 172.85 and is currently trading around 173.46.

GBPUSD- Trend- Bearish

The pound sterling recovered after poor US economic data. US ISM services PMI came at 50.30 in May, below the estimate of 52.60. Any break below 1.2360 confirms further bearishness.

USDJPY- Bullish

The pair trades lower in hopes of a rate pause by the Fed. Significant resistance is 141/142.

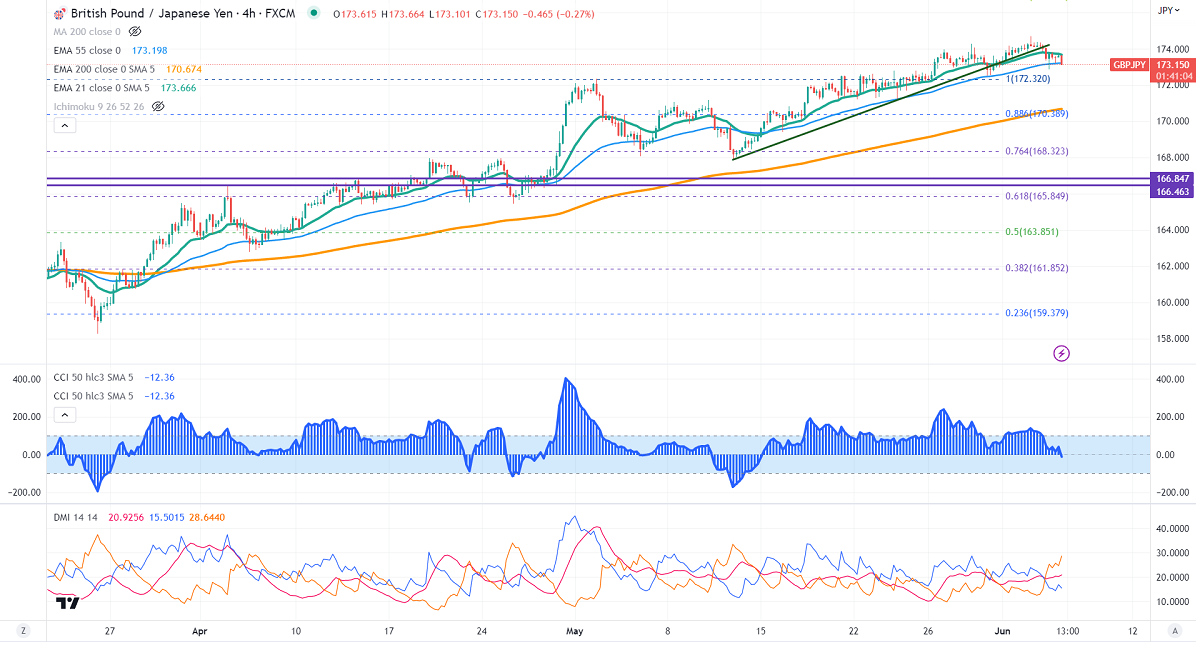

GBPJPY analysis-

The near-term support is around 172.50, a breach below targets 171.80/171/170. The immediate resistance is at 175, any violation above will take the pair to 176/177.

Indicators (4-hour chart)

CCI (50)- Neutral

ADX- Neutral

It is good to sell on rallies around 174.25-30 with SL around 176 for a TP of 172.50.