Another month into the Covid-19 lockdown and it seems to us to that GBP is in a rather more vulnerable position than was the case a month ago.

On the flip side, CAD has not even outperformed the reserve bloc is indicative that CAD is not simply underperforming because of its inherently lower beta amid the recent modest relief rally, and is instead being dragged down by a mix of idiosyncratic fundamental factors. This behavior further solidifies our conviction that on a broad-basis, CAD will be one of the distinct underperformers in G10 FX this year. Furthermore, we have briefly discussed both bullish and bearish scenarios of GBPCAD, OTC indications and suitable hedging strategies here in this write-up:

Bearish GBPCAD Scenarios:

1) The UK-EU fail to agree on a trade deal and the UK exits the transition period on WTO terms (GBPCAD to 1.63, potentially 1.60).

2) A renewed economic lockdown in the autumn/winter.

3) UK fiscal deficit extends towards 20% of GDP, so too BoE QE.

4) The COVID-19 downturn is a true v-shaped recovery.

Bullish GBPCAD Scenarios:

1) Johnson backtracks and extends the transition period into 2021.

2) A more rapid transition to COVID-19 recovery.

3) Safe haven inflows on a fully-fledged EUR debt crisis

4) The global sudden stop catalyses a large capital outflow given Canada’s BoP deficits

5) Renewed oil price war accelerates industry-wide crude production shut-ins.

OTC Updates:

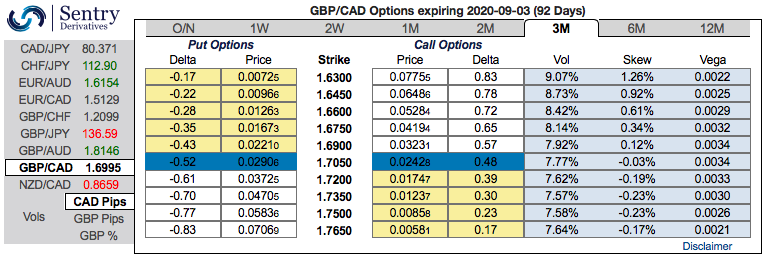

Let’s just quickly glance at GBPCAD 3m IV skews before looking at the hedging and trading strategies.

The positively skewed IVs of this pair have also been stretched towards OTM puts, bids for out of the money strikes up to 1.63 levels has been observed for 3m tenors. This indicates the hedging sentiments for the downside risks and the trend of underlying spot movement is also conducive for the options holders of OTM put options.

Hedging Strategies:

Contemplating above-explained bearish OTC sentiments signaled by the IV skews of the 3m tenors and fundamental factors, on trading perspective, debit put spreads are advocated as the selling indications are piling up.

Hence, we execute the options strategy by, buying 2w (1%) In-The-Money -0.69 delta put option and short 2w (1%) Out-Of-The-Money put option at the net debit. The strategy with deep in the money put with a very strong delta will move in tandem with the underlying spot, while short leg on Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in In-The-Money put option.

Alternatively, ahead of BoC monetary policy that is scheduled for this week, we advocated shorts in GBPCAD futures contracts of June’20 deliveries with a view to arresting potential dips. Courtesy: Sentry

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data