FX Sentiment remains buoyed, as markets eye further support from patient central banks (Fed, BoE, SNB) this week. The victory of moderate candidate Emmanuel Macron in the French presidential election has allowed the Swiss franc to depreciate significantly against the euro. This reduces the SNB’s need to intervene. While we still believe the CHF will generally remain under appreciation pressure, levels around 1.09 in EURCHF should be sustained for the time being.

However, we expect falling exchange rates again by the end of the year at the latest. The Swiss National Bank (SNB) should be overjoyed: At EURCHF levels well above 1.08, there is no longer any reason for it to intervene in the FX market to prevent a stronger franc.

We, as renowned CHF bulls, also believe current EURCHF levels should actually be sustained.

Due to the ongoing high uncertainty characterizing the political environment, the Swiss franc has recently firmed to a level of 1.13 against the euro. With respect to the most important issues (global trade dispute, Brexit, budget dispute with Italy), no easing of tension is currently in sight. For the time being, we, therefore, expect continued appreciation pressure on the Swiss franc.

Under such circumstances, we foresee the Swiss franc reach a level of around 1.12 against the euro by the end of the year. Should a Brexit without an exit agreement with the EU happen, the Swiss franc may well be subject to an abrupt surge. We expect the SNB to maintain its expansionary monetary policy stance at its next meeting (13 Dec.).

Additional volatility in the EURCHF cross may also ensue in the event of a final failure of the negotiations over the framework agreement between Switzerland and the EU.

The main event next week will be the ECB meeting with the focus on the possible dovish actions that could be in the pipeline, ranging from LTROs or rate guidance.

We do not expect any such announcements until April, but at that time they expect both rate guidance (unchanged “through 2019” from September) and that the ECB will offer a three-year TLTRO (previously a two-year LTRO). The expectation is now for the first hike from the ECB to come in March 2020.

A potential dovish pivot could add fodder to EUR downside. We have argued previously that additional policy support does not necessarily have to be EUR- negative as its main beneficiaries are banks in the periphery; moreover, implications for EURUSD could be limited as well given the recent spate of weaker US data as well.

However, it is not unreasonable to expect short EURCHF to perform even in this scenario. Ultimately, we maintain our CHF long vs EUR as a partial hedge of a combination of:

1) Any renewed deterioration in the Eurozone growth outlook

2) Potential pressure from US auto tariffs and

3) Important political events on the horizon (Brexit tentatively slated for this month, Spanish elections in April, European parliamentary elections in May). A firmer Swiss PMI this week contrasts with activity data in the Euro area that is on-margin is still soft.

OTC updates and trade recommendations: (Short in EURCHF via ITM put options, spot reference: 1.1353 levels)

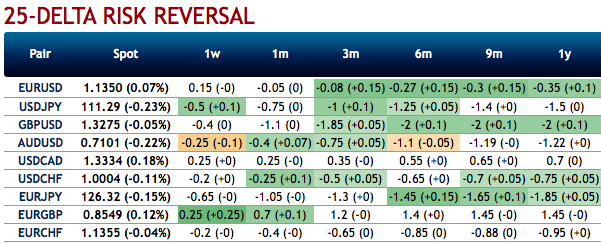

EURCHF bearish neutral risk reversal numbers and positively skewed of implied volatilities of 2m tenors signify the bearish risks to prevail further.

25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves. Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 91 levels (which is bullish), while hourly CHF spot index was at 87 (bullish) while articulating (at 12:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges